Better-than-expected earnings pushed recreational vehicle (RV) maker Thor Industries higher.

The company’s fiscal fourth-quarter earnings per share came in at $5.15, well ahead of estimates of $3.81. Additionally, its sales of $3.82 billion came in above estimates of $3.69 billion. 💪

The company said North America towable sales increased 3.8%, while North America motorized RV sales rose 24.5%. However, European RV sales suffered a drop of 16.8%, given the economic challenges and weaker currency the region is facing.

Given the high level of uncertainty, the company said it will provide its full-year 2023 guidance in conjunction with its first-quarter results. 📅

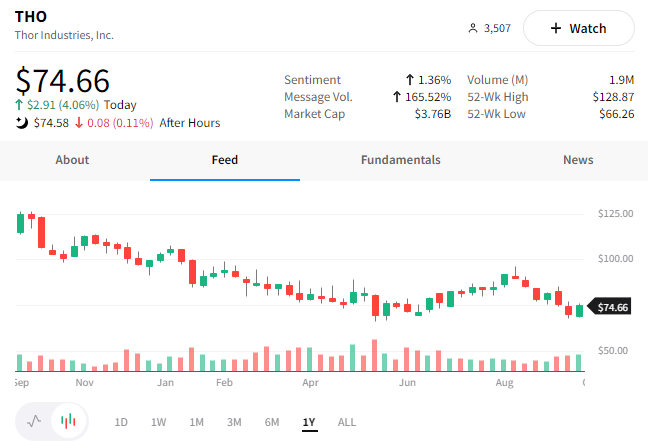

Investors appear pleased with the results, with the stock holding above its year-to-date lows and rising 4.06% today. 👍