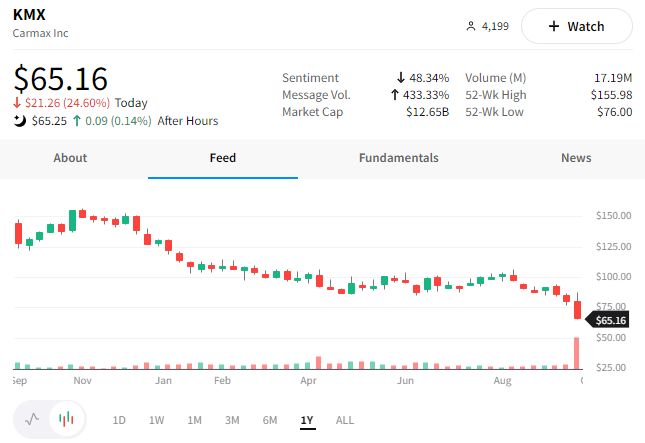

The used car market has been bonkers over the last few years, but as of now, it remains on the downswing. For example, shares of CarMax fell 25% today to a 2-year low after reporting a second-quarter profit well below expectations.

Its earnings per share was $0.79 vs. the $1.39 expected. Additionally, revenues of $8.14 billion fell short of the $8.54 billion expected. 🔻

Like in housing, the used car market faces an affordability crunch. Record-high prices, rising interest rates, and an uncertain economy have led to a steep decline in demand.

CarMax saw vehicle unit sales fall 10.30%. Meanwhile, the average price of a used vehicle sold was up 9.60%, and average wholesale vehicle prices were up 17%. Comparable-store used vehicle unit sales fell 8.30%, way higher than the consensus estimate for a 3.60% decline. 😱

With the Federal Reserve waging war on demand and prices, things don’t look great for CarMax and the used car industry. As a result, competitors like Carvana (-19.73%) and Penske (-9.16%) fell in sympathy throughout the day. 📉