Today, several of the U.S.’s largest banks kicked off earnings season as they always do.

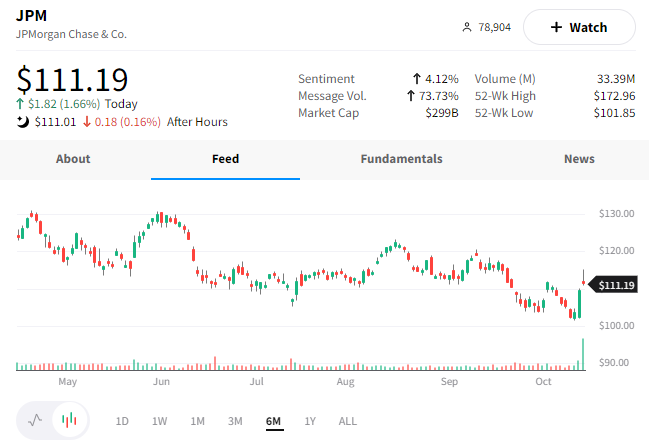

Starting with consumer banking, JPMorgan Chase topped earnings and revenue estimates. 📈

Its adjusted earnings per share of $3.12 were above the $2.88 expected, and revenues of $33.49 billion beat the $32.1 billion expected.

Earnings were down 17% YoY due to an $808 million increase in loan loss reserves, and a 24 cent per share hit related to losses on investment securities. Revenue growth of 10% YoY was driven by an increase in its net interest income, which rose 34% YoY. Higher interest rates and a growth in its loan book helped net interest income top analyst expectations by over $600 million.

While the consumer side of the business is holding up well, the investment banking side fell 47% in the quarter as the deal environment dries up. Meanwhile, trading revenue rose 8% amid the higher volatility and trading activity.

Overall, the biggest bank in the U.S. continues to paint a cautious picture of the economy. This matches the rhetoric CEO Jamie Dimon has shared throughout the year.

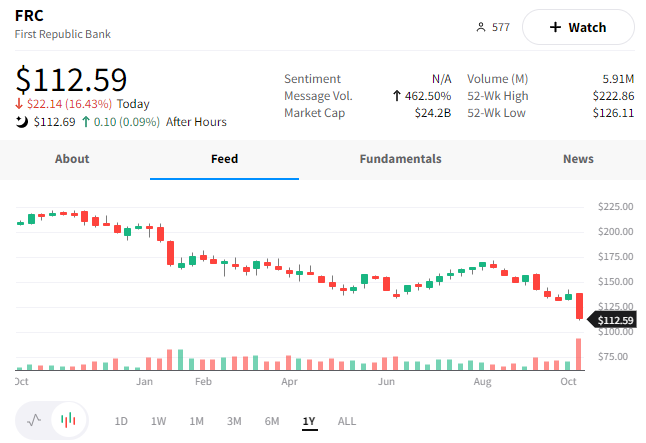

While $JPM shares enjoyed a nice pop today, they’re fresh off 52-week lows along with many of its banking-sector peers.

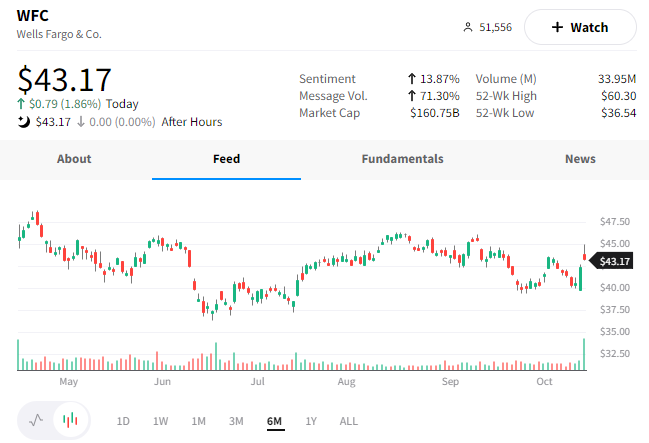

Similarly, Wells Fargo beat on the top and bottom lines. Its adjusted EPS of $1.30 and revenues of $19.51 billion came in ahead of the $1.09 and $18.78 billion expected. 💪

Like JPMorgan, it increased its loan loss reserves by $784 million given the less favorable economic environment. Meanwhile, it also suffered operating losses of $2 billion related to litigation, customer remediation, and regulatory matters. Although this is not a surprise for analysts who know the company is still working on cleaning up its act.

The company continues to divest a large part of its mortgage operations. Home lending revenue fell 52% YoY, and originations were down 59% YoY.

On the positive side, it saw a 28% jump in banking revenue due to stronger treasury management results and a 29% rise in commercial real estate revenue due to higher rates and loan balances. Similar to JPMorgan, its net interest income increased by 36% due to higher rates and loan balances.

$WFC shares rose 2% in a tough tape but sit in the middle of a longer-term trading range.

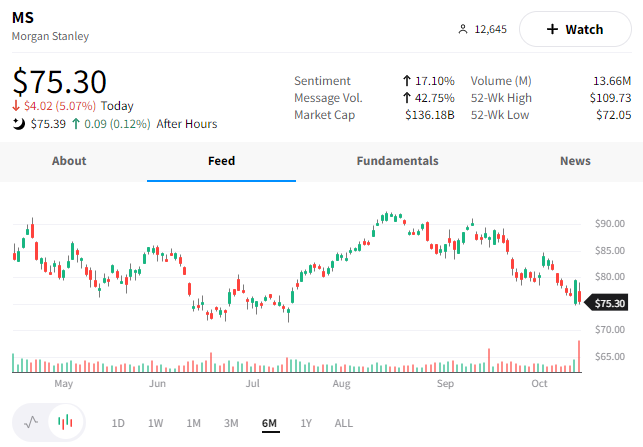

The banks performing worst in the current environment are those with larger investment banking/investment management businesses and less consumer banking exposure.

One of those is Morgan Stanley, whose earnings and revenue missed expectations. Its adjusted EPS of $1.47 and revenue of $12.99 billion were both below estimates of $1.49 and $13.3 billion.

The company saw investment banking revenue fall 55% YoY and investment management revenue fall by 20%. 😬

Shares of $MS fell by 5% today as investors digest the impact of a slowdown in its core businesses.

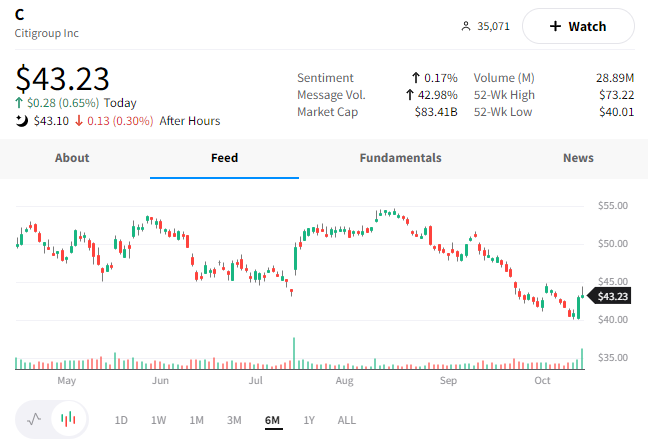

Citigroup is a mix of consumer business and investment banking, so it’s not surprising that it reported mixed results.

The bank beat on revenue ($18.51 billion vs. $18.25 billion) and earnings but saw its net income fall 25% YoY. An increase in loan loss reserves and the slowdown in investment banking activity proved a double whammy for the global bank.

Personal banking was a bright spot, with revenue rising 10% YoY. Meanwhile, fixed income revenue missed expectations, while equities revenue beat. 👍

$C shares closed slightly higher on the day.

Lastly, we must mention First Republic Bank, which was absolutely demolished. The regional bank reported better-than-expected earnings but missed on revenues. 😨

Most importantly, the company said its net interest income is running about 4bps behind its forecast for growth of 2.75%. In this industry, that’s one number you cannot afford to miss. 🚫

As a result, investors sent $FRC shares down 16% to their lowest level since October 2020.