Not only does Snapchat delete its users’ messages after they’re opened, but it also deletes its investors’ money every time it reports earnings. Or so it seems…

In May, we covered the stock as it fell 43% after slashing guidance and dragging many of its competitors lower with it. Since then, the company has been trying to turn things around by reducing expenses, restructuring its priorities, and making other efforts to reclaim profitability.

Unfortunately for investors, its third-quarter report showed that it’s still got work to do. 📝

Although adjusted earnings per share of $0.08 beat estimates for a $0.02 loss, the company’s revenue of $1.13 billion came in $0.01 billion shy of estimates. Its Global Daily Active Users of 363 million also beat the 358.2 million expected.

Snap CEO, Evan Spiegel, said, “This quarter we took action to further focus our business on our three strategic priorities: growing our community and deepening their engagement with our products, reaccelerating and diversifying our revenue growth, and investing in augmented reality…”

However, for the second straight quarter, the company has chosen not to provide guidance, stating, “Forward looking revenue visibility remains incredibly challenging, and this is compounded by the fact that revenue in Q4 is typically disproportionately generated in the back half of the quarter, which further reduces our visibility…”

On that note, he did say that YoY revenue growth would likely decelerate in Q4 due to the weaker advertising environment. 🔻

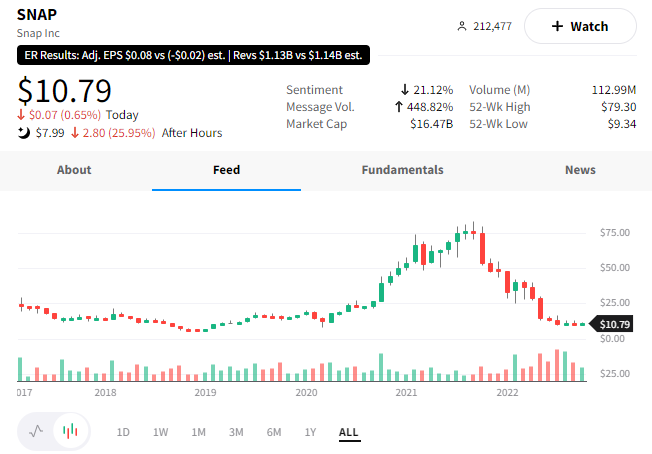

Overall, investors still appear to doubt the company’s turnaround prospects. $SNAP shares are down roughly 25% after hours to their lowest level since February 2019. 📉