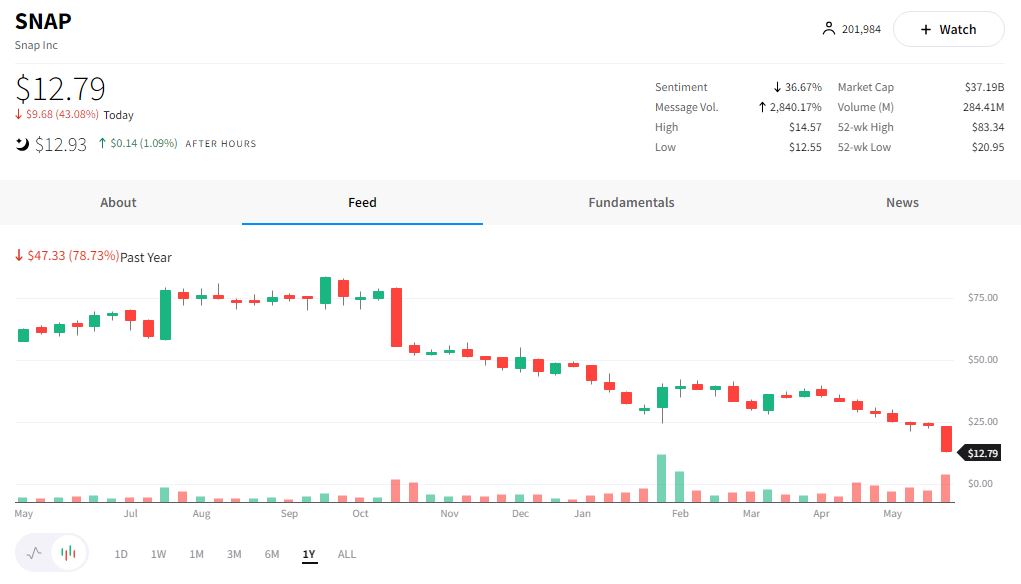

When a stock trends all morning and afternoon on StockTwits, oftentimes it’s either driven by great news or absolute carnage. 💀 Unfortunately for long-term $SNAP shareholders, on Tuesday it was most certainly an “absolute carnage” kind of day.

In what turned out to be the worst single-day price drop for Snap stock, the 40%-ish haircut seemingly had ripple effects throughout the broader stock market. 🔪 To get the full scoop on SNAP’s slashed guidance, feel free to take a gander at yesterday’s Daily Rip.

The ripple effects spread beyond Snap stock to a wider swath of stocks generally associated with social media, as the Pinterest, Twitter, Match Group, Google/Alphabet, and Meta Platforms share prices all dove in tandem with Snap, albeit to a lesser degree. ⬇️ This leaves traders to ponder whether this panic selling signifies a Snap-specific issue or a deeper, niche-wide trend.

The general consensus, it seems, is that all of the businesses in this category are facing similar headwinds, but with company-specific variations. For example, Alphabet and Google CFO Ruth Porat declined to provide specific guidance, but admitted that since “the largest impact from COVID on our results was in the second quarter of 2020,” Alphabet will face a particularly tough comp in Q2 2022 “as we lap the recovery we had in the second quarter of 2021.” Porat added, “the second quarter results will continue to reflect that we suspended the vast majority of our commercial activities in Russia.”

Match Group CEO Shar Dubey acknowledged, “Our business is not immune to the macroeconomic headwinds such as the war in Ukraine, the strengthening U.S. dollar against foreign currencies at levels we haven’t seen in a while, and lingering variants of COVID-19.” At the same time, the company anticipates $800 to $810 million in total Q2 revenue, representing 13% to 14% year-over-year growth, reflecting the “impact of the challenging current macroeconomic environment.” 🤷

Meta Platforms CEO Mark Zuckerberg had his own early 2022 complaint list, including “softness in e-commerce after the acceleration we saw during the pandemic,” as well as Russia’s invasion of Ukraine and Facebook/Meta being blocked in Russia. Apparently, though, these headwinds didn’t prevent the company from generating $27 billion in Q1 ad revenue, up 6% year-over-year.

Meanwhile, Twitter CFO Ned Segal remains confident, expecting the platform’s revenue to “grow in the low to mid-20s range versus 2021, excluding MoPub and MoPub Acquire, with performance revenue growing faster than brand,” while also anticipating $7.5 billion or more in total revenue for 2023. Turning to Pinterest, the company sees its non-GAAP operating expenses increasing by around 10% quarter over quarter in Q2. Still, the platform has guided for Q2 revenue growth of roughly 11% year over year – not too shabby at all.

In other words, Snap’s peers face challenges, but they are managing said challenges and even thriving. Perhaps Snap’s shareholders are right to bristle at Snap’s sudden guidance revision – but then, there’s a fine line between a reaction and an overreaction. Whether a 40% single-day price drop falls into the former or the latter category is the billion-dollar question which, unfortunately, will only be answered with the benefit of hindsight. ⏳