Some heavy hitters reported after the bell, and their results were…not great. Let’s take a look.

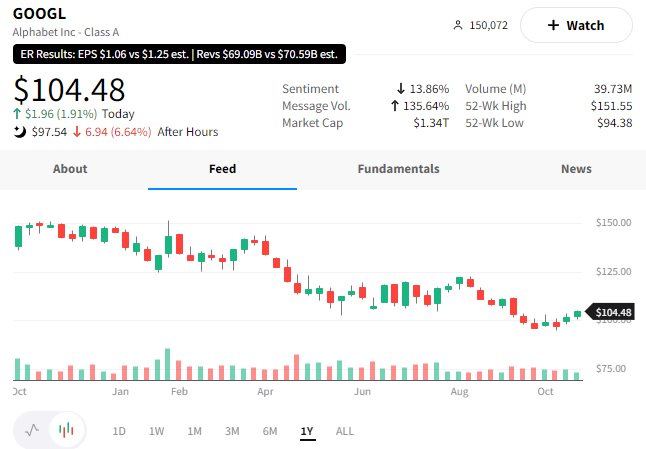

Alphabet shares are down about 7% after the company reported weaker-than-expected earnings and revenues. 🔻

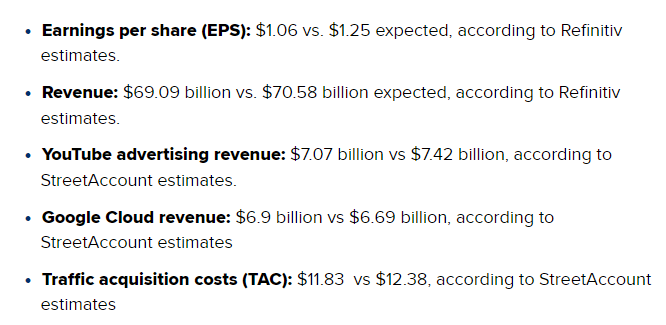

CNBC has a great summary of some of the key stats investors are paying attention to:

We’ve heard from many companies that advertising revenue is down in the current environment. Many thought misses from Snap, or even Meta, were company-specific issues. However, a miss from Alphabet shows that the advertising slowdown is broad-based and potentially here to stay.

Revenue growth of 6% vs. 41% a year earlier isn’t great, particularly as YouTube ad revenue slid 2% vs. an expected increase of 3%. Like other tech giants, the company is taking measures to cut costs and focus on profitability amid the weaker environment. ❌

Shares of $GOOGL recently rebounded from an 18-month low, so we’ll have to see how investors digest these earnings over the next few days.

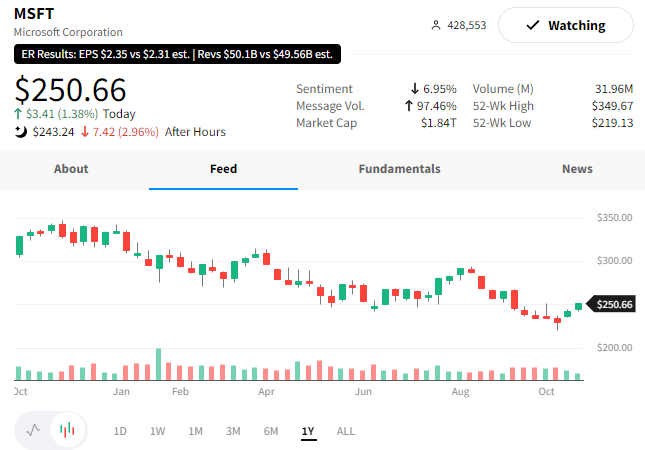

Microsoft also disappointed investors, sending shares down 3% despite a small beat on the top and bottom lines.

The company’s “Microsoft Intelligent Cloud” segment reported revenues slightly below expectations. While a slight miss may not seem like a big deal, many analysts expect this area of its business to be a major growth driver for the company. So a slowdown there isn’t what they wanted to see. 👎

Like Google, the company has recently cut costs and reduced spending on less-profitable ventures.

We’ll have to see if investors take this news in stride or if the next few days will be a rough ride. 🤷

Texas Instruments is trading down about 6% despite beating earnings and revenue estimates.

While the company had a strong quarter, it saw weakness in personal electronics and softness beginning in the industrial sector. As a result, its earnings and revenue expectations for Q4 came in below analyst expectations, which is likely why the stock is down after hours.