Some big names were on the move today after earnings, so let’s get into them.

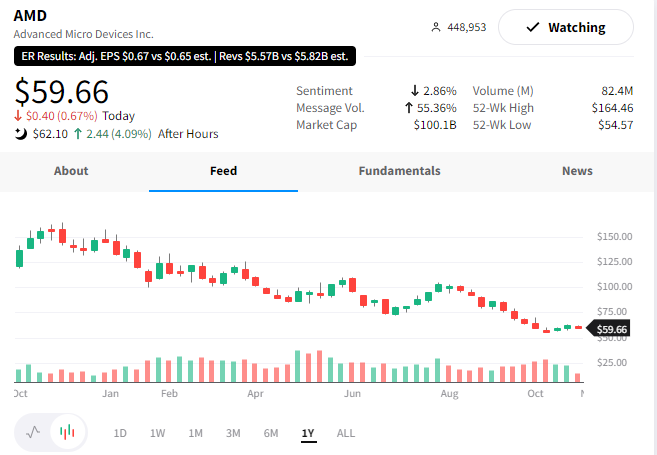

Advanced Micro Devices missed earnings estimates by $0.01 per share, and its revenues of $5.57 billion were just shy of the $5.62 billion expected. The chipmaker grew revenues 29% YoY, with net income falling 93%, primarily due to its February acquisition of Xilinx.

Looking ahead, the company cut its full-year revenue guidance again and reduced its adjusted gross margin outlook from 54% to 52%.

Despite it missing already lowered guidance and reducing its forward outlook again, $AMD shares are up about 4% after hours. Maybe enough of the bad news was priced in. Or maybe sellers just need some time to catch their breath. Only time will tell… 🤷

Sofi Technologies was up as much as 20% after topping revenue estimates but faded throughout the day to close up 5%.

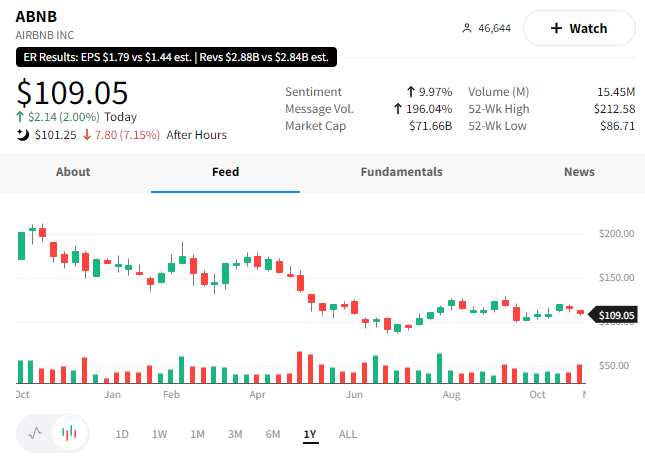

And finally, Airbnb beat earnings and revenue estimates but is dropping because of weak guidance.

The company’s adjusted earnings per share of $1.79 beat the $1.53 expected. Revenues of $2.88 billion were above the $2.83 expected. However, its nights and experiences booked number was slightly below estimates of 99.9 million at 99.7 million.

While it said Q3 was its most profitable quarter ever, it now expects Q4 revenue between $1.8 and $1.88 billion, slightly below analyst estimates of $1.86 million. The company noted several macro headwinds, including the strong U.S. dollar, inflationary pressures, and a consumer slowdown.

Shares of $ABNB are down about 7% after hours. 🔻