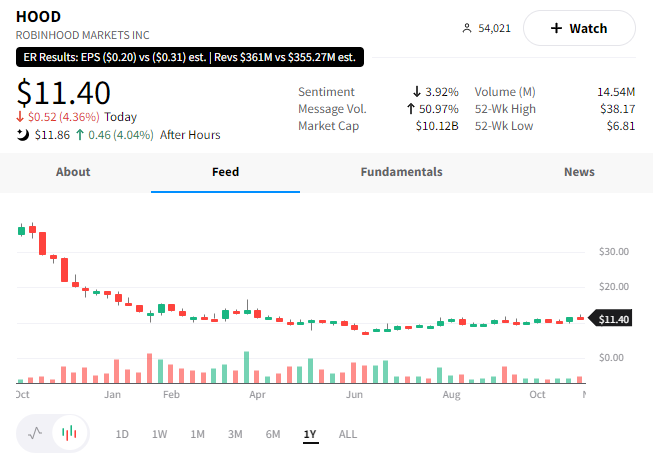

Speaking of beaten-down growth stocks, Robinhood reported earnings today! 📝

The company’s diluted earnings per share of ($0.20) beat expectations of ($0.27), while revenues of $361 million beat expectations of $357.7 million. The brokerage’s net interest revenue drove the results, rising 73% to $128 million due to rising interest rates.

Its cryptocurrency transaction revenue fell 12% to $51 million as the “crypto winter” continues. On the other hand, equity trading ticked up 7% QoQ to $31 million, and options trading revenue was $124 million. Meanwhile, its quarterly monthly active users fell well short of the 13.74 million expected, at 12.2 million.

Transaction revenue is attempting to stabilize at $208 million, down from $266 million last year but up from last quarter’s $202 million. However, like other growth darlings, the company continues to cut costs and prioritize profitability amid the weaker environment. 💵

The initial reaction from investors was positive, with $HOOD shares rising 4% and erasing their intraday losses. We’ll have to see how it holds up in the coming days or if it faces a similar fate as the growth stocks discussed above.