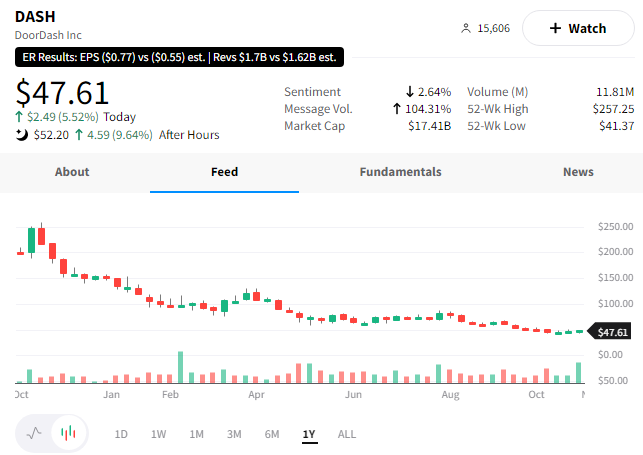

It’s been a rough time for growth stocks, but DoorDash delivered a surprise for its investors today.

The food delivery company reported better-than-expected sales and total orders but missed earnings.

Its loss per share was $0.77 vs. the $0.60 expected. Revenues of $1.7 billion beat the $1.63 billion expected. Meanwhile, total orders rose 27% to 439 million, beating estimates of 433 million.

Investors were concerned that the food delivery business would slow as inflation pressures consumers’ discretionary income. Especially since many restaurant chains have reported weaker sales, especially from lower and middle-income consumers who are trading down or skipping dining out altogether. 🥡

However, the company anticipates consumer spending will remain strong in the current quarter. It’s projecting gross order volume of $13.9-$14.2 billion, higher than Wall Street’s view of $13.73 billion.

Shares of $DASH popped 15% today on the news. As we’ve discussed, investors remain hesitant to jump back into growth stocks. So we’ll just have to wait and see if today’s move is the start new trend or yet another head fake. 🤷