It pays to be a shareholder of Block today. Meanwhile, PayPal shareholders are paying the price for holding shares through earnings.

Let’s take a look at how these financial services companies fared.

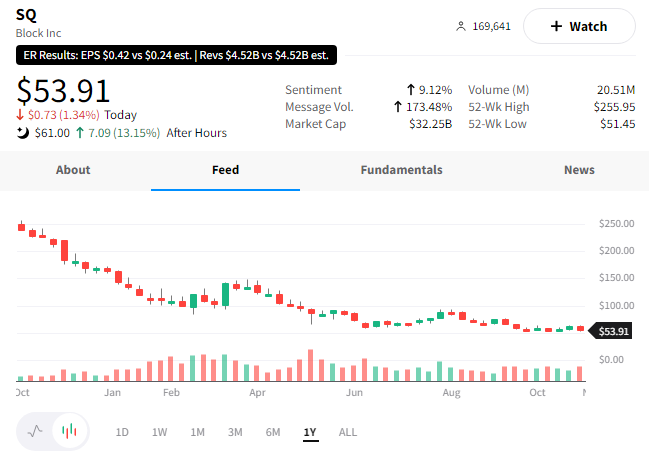

First, let’s start with Block, formerly known as Square.

The company reported better-than-expected earnings and revenue. Its adjusted earnings per share of $0.42 bested expectations of $0.23. Meanwhile, revenues of $4.52 topped estimates of $4.49 billion.

The company also shared some numbers from its core business units. Its Cash App business saw a 51% YoY rise in gross profit, while its Cash debit card users rose 40% to 18 million people. Square’s point-of-sale business also saw gross profit grow 29% YoY. 📈

Investors were happy that the company did not experience the macro slowdown that has hit other payment companies already. However, given the current commentary surrounding the global economy, many expect that to catch up to them eventually.

Still, $SQ shares are popping 13% after hours.

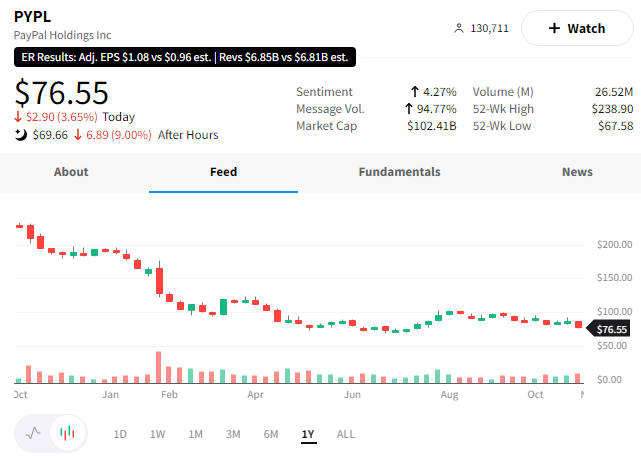

$PYPL shares did not fare as well, falling nearly 13% today despite the company beating earnings and revenue estimates. 📉

Earnings per share of $1.08 beat the $0.96 expected, while revenues of $6.85 billion beat estimates of $6.82 billion.

Looking forward, PayPal raised its EPS guidance for the full fiscal year, citing “ongoing productivity initiatives.” But what’s hitting the stock is its Q4 revenue estimate falling short of the $7.74 billion expected at $7.38 billion.

As we’ve seen with many other companies this week, forward guidance has been key. And right now, any missteps are being punished by investors. 👎

On that same note, we have to mention two other popular tech companies cratering after hours. Twilio ($TWLO) and Atlassian ($TEAM) are down big after issuing weaker-than-expected guidance. 🔻