As the Federal Reserve continues to raise rates and the economy heads for a recession, investors have little patience for money-losing companies. Especially those that aren’t growing.

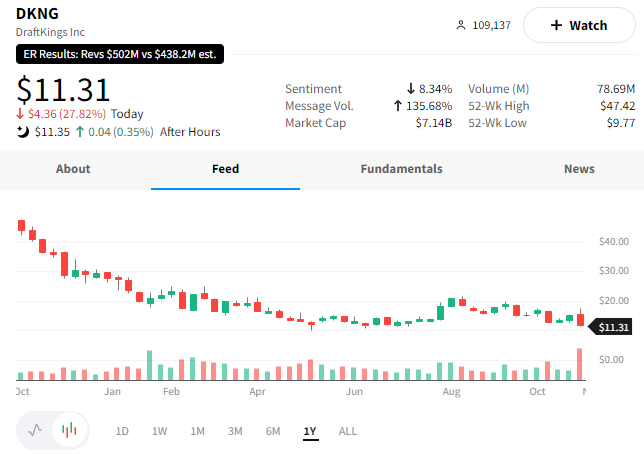

If you don’t believe us, just ask DraftKings investors, who saw their investment plunge today after the company’s quarterly earnings report. 📉

Although its revenues beat expectations ($502 million vs. 437 million) and it raised its full-year guidance, its monthly users fell short of estimates. DraftKings said it had 1.6 million monthly unique paying customers in the quarter. While that’s 22% YoY growth, it fell well short of the 2 million analysts expected.

The company hopes its online Sportsbook product expansion, which launched in September, will help drive key metrics like customer acquisition, engagement, and retention. However, investors are not waiting around to find out. $DKNG shares tumbled 28% on the day as investors jumped ship. 👎