Retailers selling discretionary items like electronics and appliances have struggled to satisfy investors after red-hot results during the pandemic. But, some signs are emerging that expectations might’ve gotten low enough, and results may be beginning to bottom out. 🤔

Today we heard from Best Buy, which reported adjusted EPS was $1.38 vs. the $1.03 expected and revenues of $10.59 billion vs. the $10.31 billion expected.

Sales continued to decline against most of its product categories, with the largest declines in computing and home theater. However, revenue is higher than pre-pandemic levels as shoppers spend more per item. Additionally, same-store sales declines of 10.4% were less than the 12.9% expected, giving investors hope that sales could be turning a corner.

Despite the uncertain macroeconomic environment and lack of clarity on consumer spending, the company is sticking by its holiday outlook. Granted, that forecast was already slashed this summer, but investors are cheering the lack of further reductions. Inventory levels are also returning to pre-pandemic levels, showing that the company may be positioned better than in previous quarters.

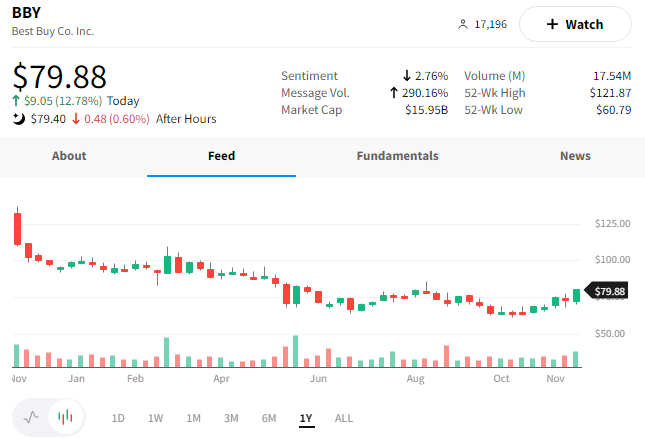

These positive improvements sent $BBY shares up 13% today. 👍