Most of this week’s earnings reports came today. Unfortunately for the bulls, the bad news outweighed the good. 👎

Let’s recap what the biggest movers had to say.

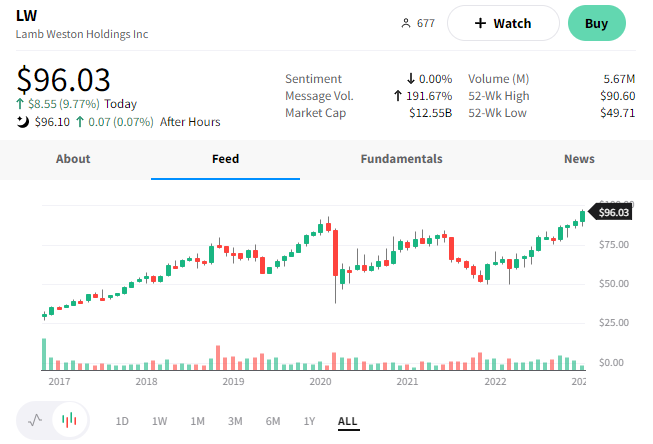

First up is Constellation Brands, which saw its $STZ share price fall 10% towards 52-week lows as higher costs hit their earnings.

Despite continued strength in its core beer business, inflationary pressures in its supply chain pushed its operating margin down to 37.5% from 41.3% last year. The company plans to continue price increases where it can but will have to absorb some of the costs in the meantime.

As a result, it lowered its full-year earnings outlook to $11 to $11.20 per share. That’s down from its previous guidance of $11.20 to $11.60 per share. 🔻

RPM International saw its shares fall today despite its earnings meeting consensus estimates.

Sales for the current quarter rose 9.3%, which was slower than the double-digit growth in its prior four quarters. On top of that, the specialty chemicals company now expects sales to grow in the low-to-mid-single-digit percentage range in its winter quarter. 📉

Additionally, foreign currency translation and higher inflationary pressures could cause its earnings growth to slow or potentially post a modest decline. That would be the first time in five quarters.

Overall, investors were unhappy with that outlook and pushed $RPM shares down 13%. ☹️

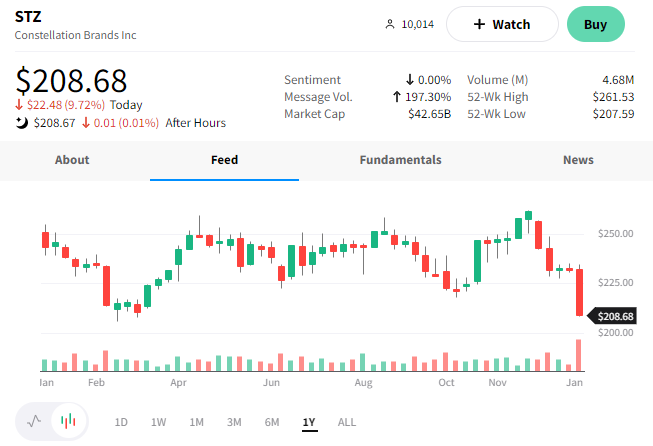

Despite beating earnings and revenue expectations, Walgreens Boots Alliance also had a rough day.

Its adjusted earnings per share of $1.16 beat the $1.14 expected. Revenues of $33.38 billion also outpaced the $32.84 billion expected. It also boosted its full-year revenue outlook despite its health care segment’s revenue coming in softer than expected. 📈

Overall, the company continues to transform from a pharmacy-led retailer to a broader health care company. In the short term, however, its earnings will continue to be impacted by ongoing Covid headwinds, high investment costs, rising labor costs for pharmacists, and higher tax rates.

For now, it appears investors cannot look past the short-term pain and towards the company’s longer-term growth story. $WBA shares continued their decline, down 6% today. 🤷

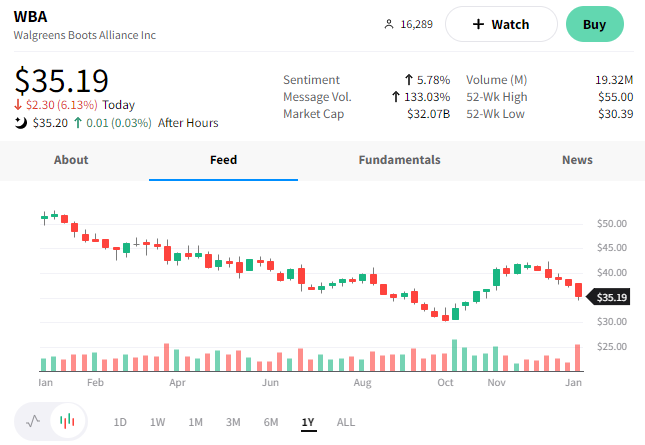

While many stocks are red, investors can count on french fries to cheer them up. 🍟

That’s because one of the world’s largest producers and processors of frozen potato products, Lamb Weston Holdings, hit all-time highs after reporting better-than-expected results.

The company raised its profit forecast for fiscal 2023 from $485-$535 million to $580-$620 million. And it’s also projecting net sales of $4.8-$4.9 billion from its previous forecast of $4.7-$4.8 billion.

$LW shares rose 10% today on the news, hitting a new all-time high in the process. 👍