Financial services earnings continue to come in, but transportation stocks were top of mind given today’s economic data. 🚚

On that note, JB Hunt Transport Services reported earnings and revenue that missed expectations.

The trucking giant saw sales rise 4% YoY to $3.65 billion, missing the $3.84 billion expected. Earnings per share (EPS) of $1.92 missed analyst estimates of $2.46. 📝

Excluding fuel surcharge revenue, its operating revenue fell 3% YoY. Driving that decline was a 27% decrease in volume in Integrated Capacity Solutions (ICS) and a 1% decline in Intermodal volume. The company’s operating income fell 13%, and its operating margin was 7.7%.

Like other shippers, it’s experiencing shrinking volumes that are being offset by price increases. However, rising costs are eating at its margin and profitability.

Despite the weaker-than-expected results, $JBHT shares rose 5% today. 🤷

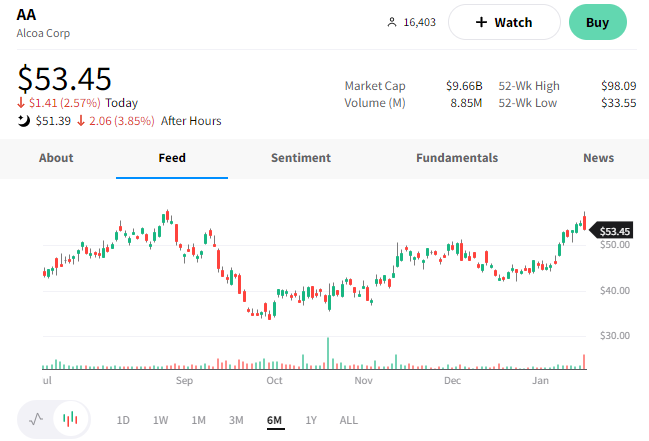

Aluminum company Alcoa is extending its decline after hours following a weaker-than-expected earnings report. 🏭

It reported Q4 earnings per share of $0.70, three cents worse than expectations. However, revenues of $2.7 billion topped expectations of $2.66 billion.

Driving the results was a 7% decline in third-party revenue, attributable to lower prices and shipments of alumina and aluminum. Average realized third-party prices were down 8% and 10%, respectively. Additionally, third-party shipments were down 2% and 3%, respectively. 🔻

The company generated roughly $118 million from operations and finished the quarter with a cash balance of $1.4 billion. It also paid a dividend of $0.10 per share, totaling $17 million.

Overall, investors remain concerned with how the economic slowdown will impact industrial companies like Alcoa.

As a result, $AA shares were down roughly 4% after hours. 📉

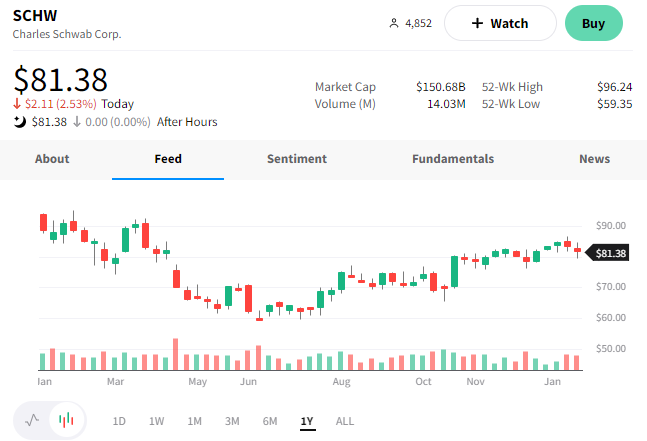

Financial services firm Charles Schwab reported earnings and revenue that fell short of expectations. 👎

Earnings per share of $0.97 were below the $1.09 estimate. And net revenues of $5.5 billion fell short of the $5.6 billion expected.

Interest income rose 65% YoY to $3.8 billion, with net interest expense rising 534% YoY to $812 million. Trading revenues declined by roughly 10.5% to $895 million. Investor appetite for savings accounts and other fixed-income products helped bolster the company’s results. It also managed to add new clients in the quarter. 💰

$SCHW shares were down 2.53% on the news.

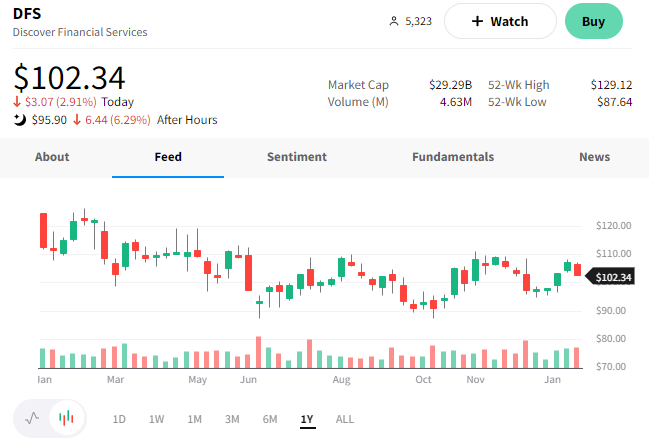

Discover Financial Services beat expectations, but the stock is falling sharply.

The company reported earnings per share of $3.77 vs. the $3.65 expected. And revenues of $3.73 billion beat the $3.668 billion expected.

Like other consumer banks, it increased its provision for credit losses by 42% to $883 million. It also saw its overall net charge-off rate (what the company believes it’s unlikely to recover) rise to 2.13%. 🔺

While the jump in loan growth helped its results, signs are mounting that consumers are struggling to cope with rising prices. Not only are they relying more on credit to maintain their lifestyles, but they’re having trouble making payments. And carrying balances with credit card interest rates at decade-plus highs is not a great thing over the long term. 💳

As a result, investors are looking past this quarter’s beat and ahead to the challenges ahead for Discover and other consumer banking businesses.

$DFS shares extended their decline after hours, falling another 6%. 📉