Today’s biggest earnings report by far was from Netflix, which delivered a solid showing.

The streaming giant’s earnings per share of $0.12 missed estimates of $0.45 by a wide margin. Driving the miss was a loss related to euro-denominated debt. The company reiterated that the U.S. Dollar’s depreciation during the quarter is a financial loss as opposed to an operational one. 💱

Revenues of $7.85 billion were in line with expectations, but margins of 7% topped estimates.

The primary number investors are focused on is its global paid net subscribers. It added 7.66 million subs in Q4, soaring past estimates of 4.57 million. The results also included its ad-supported service, which launched in November. However, the company did not disclose what portion of new subscribers selected this tier. 📺

Additionally, executives said they will still report subscriber numbers in future earnings reports, but they’ll no longer provide guidance. The change comes as the company shifts its focus to revenue instead of membership growth as its primary top-line metric. 💰

A higher subscriber count and a higher average price per membership caused the company to predict revenue growth of 4% in Q1. This is higher than the 3.7% Wall Street projected. It’s also rolling out additional features like its paid sharing program during the quarter, which could boost revenues.

Finally, the company disclosed that co-CEO Reed Hastings is stepping down from his position and transitioning to executive chairman. Greg Peters, who is currently chief operating officer, will replace him as co-CEO alongside Ted Sarandos. 👨💼

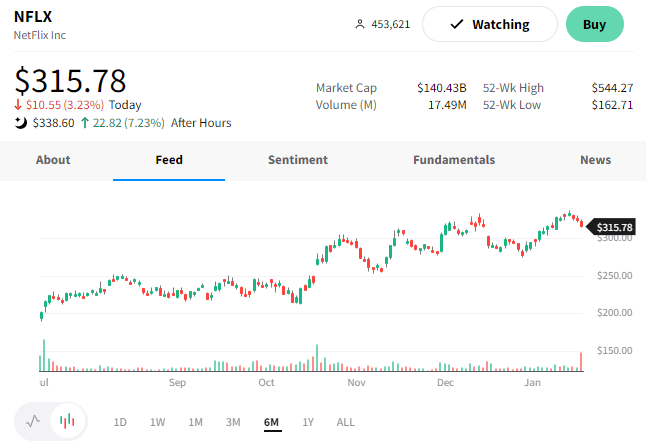

$NFLX shares were up about 7% after hours on the news. 👏