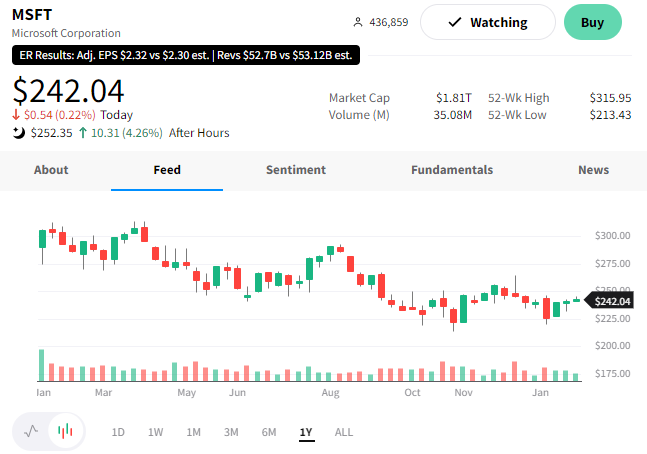

One of today’s biggest earnings announcements came from Microsoft, which beat on earnings but missed revenue expectations.

The tech giant’s adjusted earnings per share (EPS) of $3.32 beat the $2.29 expected. Revenues fell short of the $52.94 billion expected at $52.75 billion. 📝

Driving some of the earnings weakness was a $1.2 billion charge associated with cutting 10,000 jobs, revising its hardware lineup, and consolidating leases during the quarter. Like its peers, Microsoft is taking proactive steps to streamline its operations and prioritize its growth initiatives.

In terms of sales, the company’s YoY revenue growth was the slowest since 2016, rising just 2%. 🐌

Getting into product segments, Windows EOM fell 39% YoY, and Xbox content + services fell 12%. These declines were largely expected, as the demand for personal computers (PC) and gaming items pulled back from the covid-period highs.

On the positive side was the company’s cloud revenue. Azure + other cloud services rose 31%, and server products + cloud services rose 20%. Growth in that business, while decelerating, continues to offset weakness in other business segments. 👍

Overall, investors are focused on the positives in this report. Amazon shares also jumped after hours on the back of this cloud news, as it’s investing heavily in Amazon Web Services (AWS).

$MSFT shares are up 4% after hours. We’ll have to wait and see if this news truly is positive or if investors have their heads in the clouds… 🤷