Despite muted results and outlook from Visa and Mastercard, American Express came into today’s earnings report like the Kool-Aid Man. 🤩

Needless to say, the results have its investors saying…”Oh yeah!”

On that note…let’s get into the details. 🕵️

The company saw adjusted earnings per share of $2.07 vs. the $2.23 expected. Revenues of $14.18 billion also came in light of the $14.23 billion expected.

Driving some of that weakness was a roughly 18x increase in provisions for credit losses. Like other consumer financial services companies, Amex is seeing higher net write-offs and delinquency rates as credit quality deteriorates. With that said, executives say these metrics are still below pre-pandemic levels, and the company does not expect them to return to pre-pandemic levels in 2023. 📆

Total network volume rose 12% YoY to $413.3 billion as the company’s focus on premium customers continues to pay off. Millennial and Gen Z customers are the largest growth drivers, representing more than 60% of consumer card acquisitions in the quarter and full year.

While other financial services firms have offered cautious guidance, Amex is taking a more optimistic view. It forecasts full-year revenue to grow by 15% to 17% and earnings per share of $11.00 to $11.40. This is above the consensus view for 11% revenue growth and $10.53 in earnings. 👍

For additional context, here’s what CEO Stephen Squeri had to say: “We’re acquiring spending, and we see future travel bookings [strong] so I don’t see it [a recession] in my numbers at all. It’s really hard for me to get my head around that in quarter three or quarter four we’re going to have a big slowdown…” and “…But if we learned anything during the pandemic, you kind of go day to day, month to month and so, as I sit here today, I do not see it [a recession].”

That’s definitely a rosier outlook than we’ve heard from many executives. Combine that with the company hiking its dividend by 15% to $0.60 per share, and you’ve got the recipe for a sharp rally in the stock. 📈

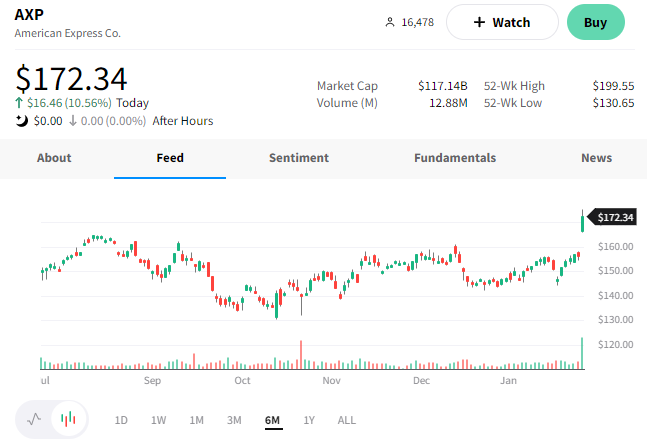

$AXP shares were up 11% on the news. 💰