Semiconductors remain a crucial focus for market participants as a leading indicator for the tech sector and global economy. As a result, when big names in the industry report earnings, they attract a lot of attention. 👀

Today we heard from Samsung Electronics, which saw its quarterly profits fall 69% to an 8-year low of $3.5 billion. Revenues also fell 8% to $57.3 billion. Analysts had expected the poor results given the company’s pre-earnings announcement earlier this month, but these were still difficult for investors to stomach. 🤢

Executives blamed a business environment that significantly deteriorated due to concerns over a global economic slowdown. Its mobile and personal computer (PC) segments suffered as customers adjusted their inventories to reflect the macro uncertainty.

The smartphone and PC weakness is something we’ve seen from most companies this quarter, so that’s not surprising. Unfortunately for Samsung, strength in other segments wasn’t enough to offset that decline. 🖥️

Analysts expect quarterly profits to remain pressured as demand stays soft and memory chip prices continue to fall. Shares of Samsung were down about 4% in U.S. trade. 🔻

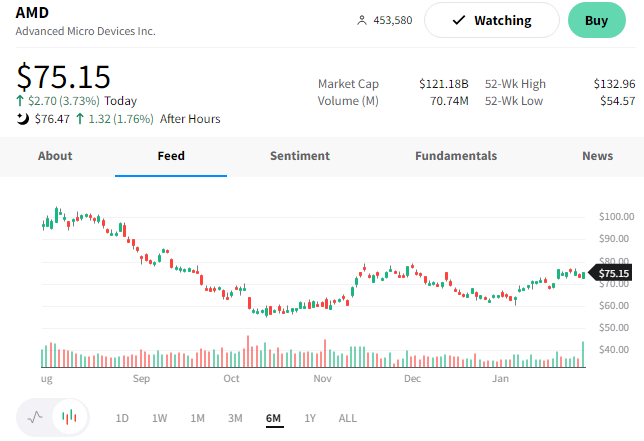

Meanwhile, Advanced Micro Devices managed to eke out an upside surprise, beating on the top and bottom lines. 😮

The company’s adjusted earnings per share of $0.69 beat the $0.67 expected. And revenues of $5.6 billion topped the $5.5 billion consensus estimate.

AMD is also facing slowing sales of its PC chips and graphics processors. Its client group segment saw a 51% YoY decline in revenue as its customers have too much inventory of its chips on hand. In addition, its gaming business was also down 7% YoY. However, its 42% YoY growth in data center revenue helped offset this weakness and boost results. ⛅

Executives expect $5.3 billion in sales for the current quarter. That’s slightly below estimates and represents a 10% QoQ decline. They also expect a key metric, adjusted gross margins, to be about 50% in the quarter.

Overall, its “better-than-its-peers” results were enough to keep its stock in the green. $AMD shares were up another 2% after hours. 👍