Bob Iger returned in November as Disney’s captain to “right the ship.” And just one quarter into his efforts, the company looks to be turning in the right direction. 🚢

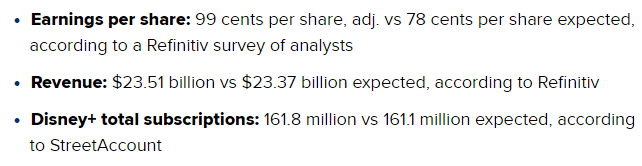

Today Disney reported better-than-expected fiscal first-quarter results. CNBC has the breakdown:

Iger’s first order of business has been reducing expenses and putting the creative power back in the hands of its content creators. As part of that effort, he announced thousands of job cuts and cost-cutting measures of $5.5 billion. The restructuring will leave a company with three distinct divisions: Disney entertainment (most of its streaming and media operations), ESPN (TV network and ESPN+), and Parks, Experiences, and Products. 💰

The bright spot remains its parks, experiences, and products divisions, which saw a 21% YoY increase in revenue during the quarter. Its streaming business remains in the negative, but losses are narrowing. The price hikes it implemented last quarter helped buoy revenue, and fortunately, more subscribers stuck around than initially expected. It originally forecasted Disney+ subscriber losses of 3 million due to the price hikes. Yet it only saw a 2.4 million decline. 📺

Lastly, Iger will ask the board to reinstate the dividend by the end of the calendar year. And while it will be a modest dividend initially, he expects the company will build on it over time.

Investors appear to share in Iger’s optimism, as $DIS shares were up roughly 6% on the news. 👍