The electric vehicle startup Fisker is on the move after its earnings news came in better than expected. This comes a week after EV startups like Lucid and Nikola indicated that their production and delivery numbers were lower than estimated. 📰

The company’s fourth-quarter net loss of 54 cents per share and revenues of $306,000 were both shy of estimates. Wall Street had expected a 42 cent per share loss and revenue of $2.5 million.

Roughly 56 Fisker Oceans were built by manufacturing partner Magna International, with fifteen completed before year-end. Early tests indicate that the vehicle may have more than the 350 miles of range initially expected. That reinforces the company’s expectation that, at its launch, the Fisker Ocean will have the longest range of any SUV/Crossover under $70,000. 🚗

The required testing for regulatory approval of Ocean should be completed next month, with the company ramping up production and beginning deliveries in Q2. It added roughly 3,000 reservations in the fourth quarter, totaling 65,000 as of February 24th. And it also said it’s on track to build more than 40,000 vehicles in 2023. ⚡

As for 2022, Fisker spent just $702 million, well below its guidance range of $715 to $790 million. Executives expect to spend between $535 and $610 million in 2023. As for profitability, it’s targeting gross profit between 8% and 12%, and it may have positive earnings before interest, tax, depreciation, and amortization (EBITDA) for the entire year too.

Investors seemingly looked ahead, with positive production news and reduced costs outweighing last quarter’s earnings and revenue shortfall. The company also made progress on its lower-cost second model called Pear. The vehicle remains on track to begin production next year. 👍

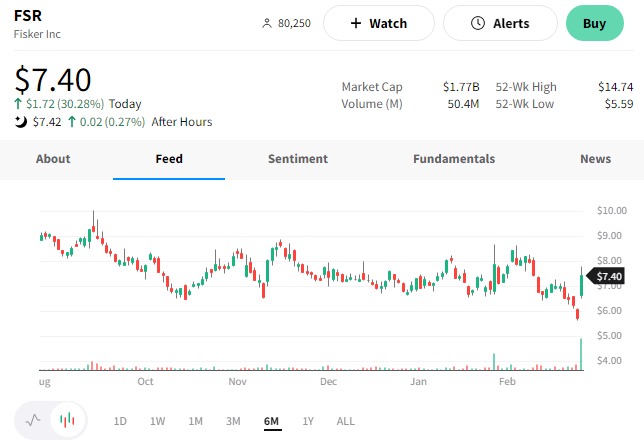

$FSR shares were up 30% on the news. 📈