Chinese e-commerce giant JD.com posted better-than-expected fourth-quarter earnings and revenue. However, its weak outlook left investors hoping for more. 🙁

The company’s adjusted earnings per share of $0.70 and revenues of $42.80 billion topped the expected $0.51 and $42.53 billion.

While China’s zero-Covid policy weighed on the results of the country’s largest companies, JD focused on improving its operations and preparing for the future. Those efforts helped boost its earnings in a challenging environment. 🔺

With that said, executives expect the macro challenges to continue this year, saying they remain focused on lowering costs, increasing efficiency, and improving the user experience. They also announced a $0.62 quarterly dividend payment to help appease investors. 💰

Overall though, investors remain concerned with the slowing pace of revenue growth. Sales grew just 7% YoY during the quarter, down again from the previous year despite China’s economy reopening. Like other tech giants, JD must identify new ways to reaccelerate its growth to regain the market’s favor.

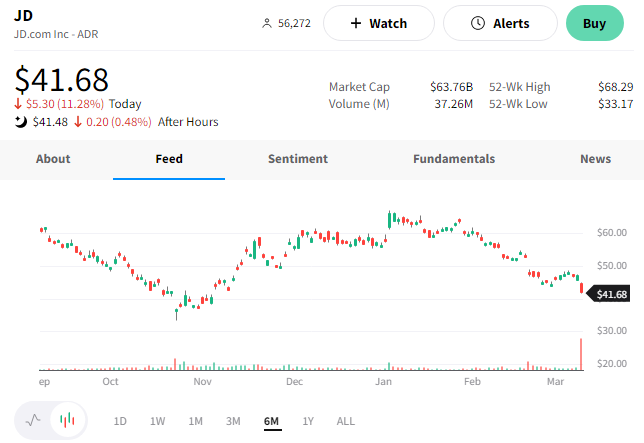

$JD shares fell 11% on their highest volume since last May. 😮