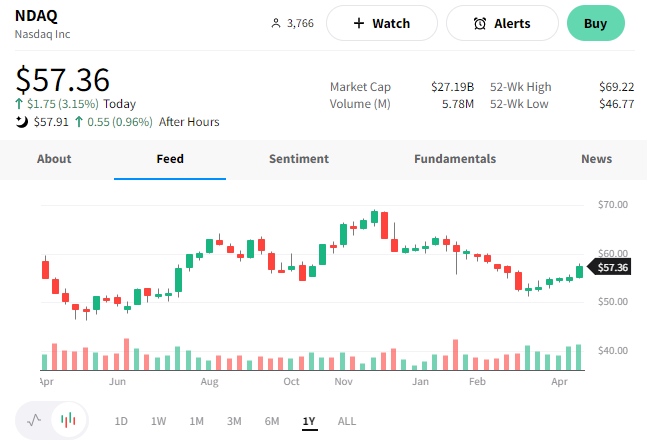

Casino operator Las Vegas Sands reported better-than-expected results, rewarding investors after hours. 💰

The company’s non-GAAP earnings per share (EPS) of $0.29 beat the $0.09 expected. Meanwhile, revenues grew about 125% YoY to $2.12 billion, topping the expected $1.83 billion.

Driving the results was a travel and tourism spending recovery in Macao and Singapore. Its Marina Bay Sands’ gaming revenue reached an all-time property high of $549 million. And Macao’s gaming revenue reached $1 billion for the first time since 2019. 🎰

Executives’ longer-term investments appear to be paying off as the region’s post-COVID recovery continues. They remain optimistic that both properties will see continued momentum throughout the year as pent-up demand drives consumers to the region. ✈️

$LVS shares rose 5% after hours, with investors’ eyeing the 2020 and 2021 highs. 📈

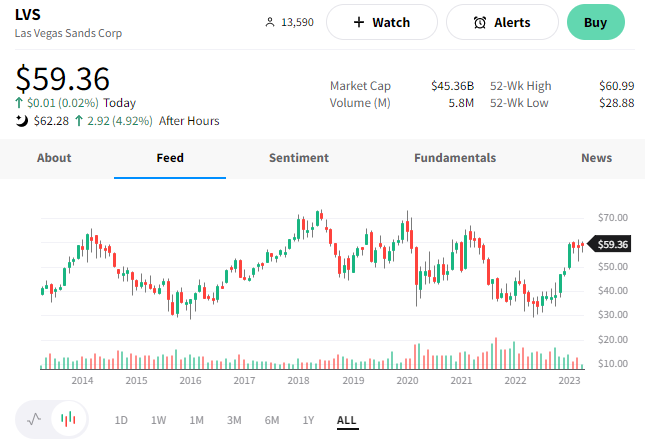

Meanwhile, another casino stock also had a great day. We’re talking about Nasdaq and are only slightly kidding about it being a casino. 😅

The stock exchange operator reported Q1 adjusted earnings per share (EPS) of $0.69 on revenues of $914 million. Both numbers topped estimates by a smidge, with revenues breaking down like this:

- Solutions Businesses Revenues of $646 million (+4% YoY)

- Trading Services Net Revenues of $267 million (+1% YoY)

- Net Revenues of $914 million (+2% YoY)

- Annual Recurring Revenue (ARR) of $2.035 billion (+7% YoY)

Executives updated their 2023 non-GAAP operating expense guidance to $1.78 billion to $1.84 billion, with a non-GAAP tax rate of 24%-26%. They also mentioned taking a thoughtful and strategic approach to growth, including artificial intelligence (AI). 🤖

Ultimately, they believe their strong capital position and free cash flow generation allow them to invest in growth initiatives while rewarding shareholders along the way. As such, the company increased its quarterly dividend by 10% to $0.22 per share. 💸

Shares of $NDAQ rose 3% as investors digested the news. 👍