Six Flags Entertainment has been a rollercoaster ride for investors. However, today that ride took a turn for the better after the company reported better-than-expected Q1 results. 🎢

The theme-park operator’s net loss of $0.84 on $142.2 million in revenue topped the $0.89 and $132.6 million expected. 👍

Average spending per capita was +7% YoY, driven by higher ticket prices propelling park admissions revenue by 10% YoY. Meanwhile, average spending inside the parks was soft at +3% YoY. And attendance was down marginally to 1.6 million, driven primarily by severe winter weather in California and Texas. ⛈️

Unfortunately, the company had to roll some of its debt out at higher interest rates. In early May, it completed the private sale of $800 million in 7.25% senior unsecured notes due 2031. The net proceeds and part of its cash balance repaid roughly 94% of the principal outstanding on its 4.875% senior unsecured Notes due in 2024.

As the company heads into its busiest time of the year, executives are optimistic. They believe their new event-driven strategy and culture will help drive park attendance and spending. That said, the vision remains unclear for investors, who have experienced wild swings in the stock. 🤷

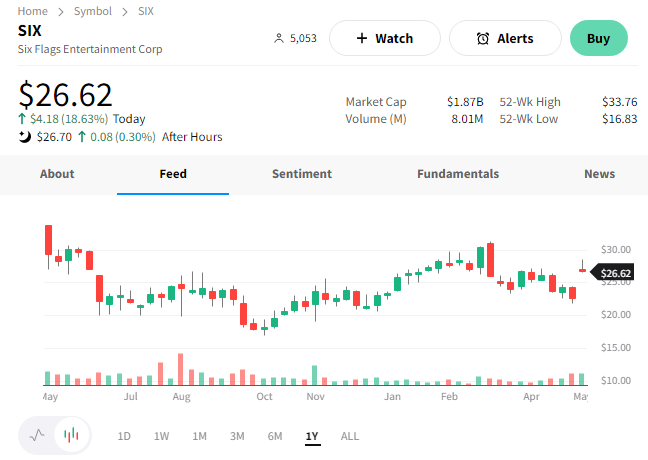

$SIX shares rose nearly 20% but remain in the middle of a year-long range. 🔺