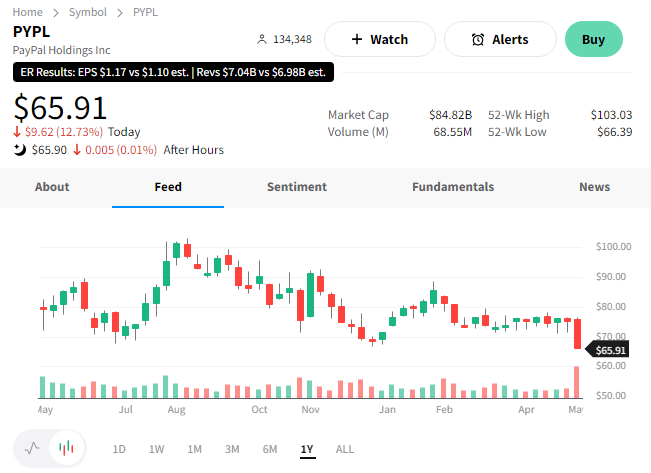

Despite beating first-quart expectations and raising full-year guidance, PayPal shares fell over 12% today. That made it the worst performer in the S&P 500 and Nasdaq 100. 😱

The company’s adjusted earnings per share of $1.17 and revenue of $7.04 billion topped the expected $1.10 and $6.98 billion. Its total payment volume of $354.5 billion also beat the $344.9 billion estimate.

Below are the year-over-year comparisons:

- Total payment volume +10% YoY

- Net revenues +9% YoY

- GAAP EPS +61% YoY and Non-GAAP EPS +33% YoY

- Operating Cash Flow -4% YoY and Free Cash Flow -3% YoY

Executives were upbeat about the full-year outlook, raising their adjusted EPS forecast from $4.87 to $4.95. However, their margin comments spooked investors. They now expect 100 basis points of operating-margin expansion this year, down from their previous outlook of 125 basis points. 🔻

Ultimately, investors are concerned about how much of the company’s growth is coming from its lower-margin part of the business. They’re happy the company is making more sales but unhappy that it’s keeping less of each dollar it receives. And therein lies the problem. ⚠️

The mismatch in expectations sent $PYPL shares to their lowest level since late 2017. 📉