Retail brokerage Robinhood reported better-than-expected Q1 results after the bell. 🔔

Its adjusted loss per share came in at $0.57 vs. $0.62 expected. Revenue was $441 million vs. $425 million expected.

Total revenues of $441 million were higher than the $425 million expected. And transaction-based revenue broke down into options at $133 million (+7% QoQ), crypto at $38 million (-1% QoQ), and equities at $27 million (+29% QoQ). 🔺

Notably, net interest revenue topped transaction-based revenue for the first time, albeit by a small $1 million margin. Driving its 25% QoQ increase in net interest revenue was growth in interest-earning assets, increased securities lending activities, and higher short-term interest rates. 💰

Other key stats included:

- Monthly active users (MAUs) +400k QoQ to 11.8 million

- Net cumulative funded accounts +120k QoQ to 23.1 million

- Assets under custody (AUC) +26% QoQ to $78 billion (net deposits of $4.4 billion)

- Average revenue per user (ARPU) +$11 QoQ to $77

Overall, the company continues to diversify its revenue streams. While it continues to improve its offerings for active traders, it’s been courting longer-term investors with products like its Gold cash sweep program and Robinhood retirement accounts. It plans to expand on that by providing low-cost personalized advisory services in IRAs shortly. 💰

Meanwhile, active traders can look forward to its plan to offer 24/5 trading access to certain stocks and ETFs. It expects the rollout to start next week and looks to add futures trading by the end of 2023. 👍

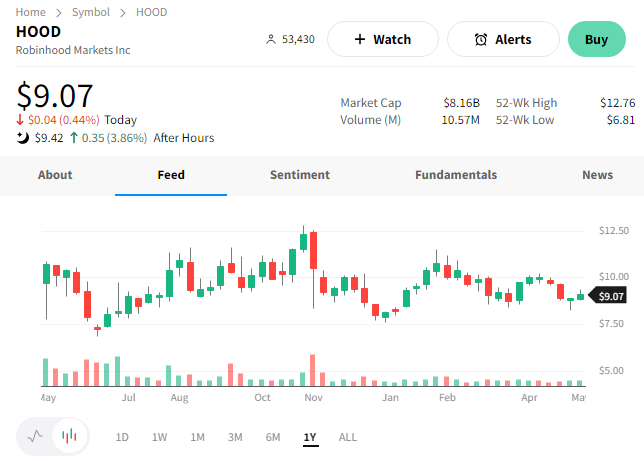

While the company’s value is still nearly 90% below the all-time highs set during 2021’s mania, it has stopped going down over the last 12 months. Its cost-cutting efforts and focus on expanding its customer base show that executives recognize the need for a more diversified business model. We know not down isn’t up. But it’s a start. 🤷

$HOOD shares were up 4% after hours. They’re currently approaching the top of their year-long trading range, so investors will be watching closely. 👀