After Home Depot’s lackluster results, all eyes are on other retailers for hints about consumers’ health. Today we got more clues from Target and TJX Companies, so let’s take a look.

First up is big-box retailer Target, which managed to hit its financial targets despite a sales slowdown. 🎯

Adjusted earnings per share (EPS) of $2.05 on revenue of $25.32 billion topped the expected $1.76 and $25.29 billion. Comparable store sales were flat YoY, with shoppers spending less as the quarter went on. Consumers also shopped differently, with digital sales falling 3.4% YoY, as overall shopper traffic edged out a 1% YoY gain.

Discretionary categories posted mid-single-digit to low-double-digit sales declines. Beauty led the consumer staples’ strength, growing by a mid-teens percentage YoY. Food and beverage were next with high single-digit growth. And household essentials rose low single-digits, driven by health and pet items. 🛒

Another positive was that inventory fell 16% YoY, signaling that its heavy discounting may be coming to an end. That and lower freight costs helped push Target’s gross margin up to 26.3%.

With that said, executives stuck with their cautious full-year outlook. They expect comparable sales from a low-single-digit decline to a low-single-digit increase and full-year EPS of $7.75 to $8.75. Although customers are buying fewer discretionary goods, the retailer is luring them in with groceries and everyday essentials to buoy results. ⚠️

$TGT shares were up nearly 3% today as the news was better than investors anticipated. 👍

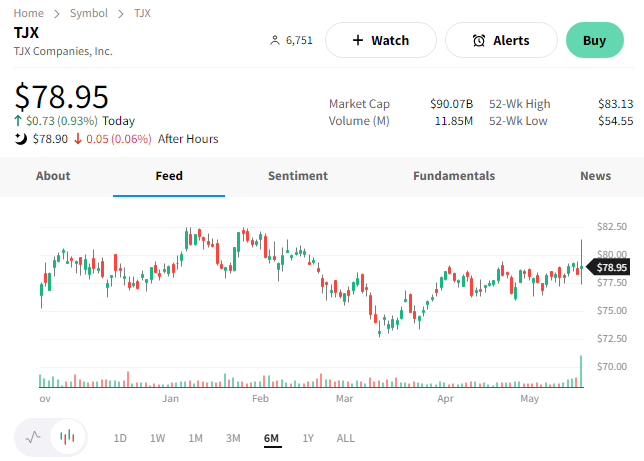

Meanwhile, off-price department store TJX Companies offered a mixed forecast. 🏬

The parent company of TJ Maxx, Marshalls, Home Goods, and other off-pice stores should be a big beneficiary of the current environment. And it was, to a certain extent.

It reported first-quarter earnings per share of $0.76 on revenues of $11.8 billion. That revenue number aligned with expectations, while earnings beat by $0.04. Same-store sales jumped 3%, topping the 2.7% consensus view.

However, the company’s conservative guidance caught some investors off guard. Both its current-quarter and fiscal-year earnings forecast were below expectations. Despite being the right business for the current economic environment, executives remain hesitant to bet on a pickup in consumer spending. 🤔

The mixed messaging initially sent shares of $TJX up 4%, though they closed up 1% on the day. 🔺

Overall, the cautious messaging from retailers continues. While many have gotten their inventory and costs back under control, they’re not anticipating a significant upswing in consumer spending this year. Instead, the base case seems to be moderate declines or flat sales for the foreseeable future. However, the overall economy remains the critical wildcard out of their control. 🤪

We’ll see what Walmart has to add to the conversation when it reports tomorrow before the bell. 👀