MSG shareholders are celebrating after it reported better-than-expected results. But first, let’s all get on the same page about how MSG is structured. ⏸️

Madison Square Garden Sports Group ($MSGS) is the leading professional sports company that owns the New York Knicks and New York Rangers. It also owns two development league teams and operates a professional sports team performance center. Meanwhile, Madison Square Garden Entertainment Corp ($MSGE) is a leader in live entertainment. It owns world-renowned venues like New York’s Madison Square Garden and Radio City Music Hall, among others.

Both entities were part of Madison Square Garden, Inc. ($MSG) before it completed restructuring in mid-April. As a result of the spin-off, this $MSG symbol is no longer active in the public markets. 🪦

For this story, we’re referring to the venue-owning part of the brand ($MSGE). Let’s dive in. 👇

The company’s GAAP earnings per share (EPS) of $0.42 doubled the $0.21 estimate. Meanwhile, revenues rose 3.7% YoY to $201.23 million, beating the consensus view by roughly $9 million.

Some other key stats included:

- Arena license revenue with NY Knicks & NY Rangers +$11.7 million YoY.

- Food, beverage, and merchandise revenue +$10.1 million YoY

- Christmas Spectacular revenues +$3.5 million YoY

- Advertising sales commission -$9.6 million YoY

- Direct operating expenses of $115.1 million (+5% YoY)

- Selling, general, and administrative expenses of $44.1 million (-6% YoY)

It’s also nearing the sale of the “Theater at Madison Square Garden” for roughly $1 billion. The buyer is Italian developer ASTM Group who is currently renovating the famous Penn Station rail hub. However, it must demolish the 5,500-seat theater to continue its expansion plans. 💰

Executives remain optimistic about the new chapter as a standalone, pure-play live entertainment company. To reflect last month’s spin-off from Sphere Entertainment, they refined their fiscal year 2023 outlook. They’re now expecting $835 to $845 million in revenue, $85 to $95 million in operating income, and $145 to $155 million in adjusted operating income. 🔺

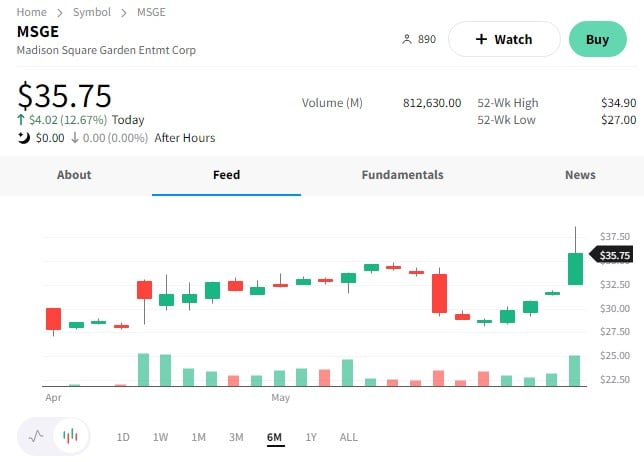

Investors appeared “entertained” by the results as $MSGE shares rose 13% to new highs. 👍

And speaking of entertainment, it’s worth noting some Sony news. The company is reportedly considering a partial spin-off of its financial business as it doubles down on entertainment and image sensors. Did somebody say a Sony shakeup??? 👀