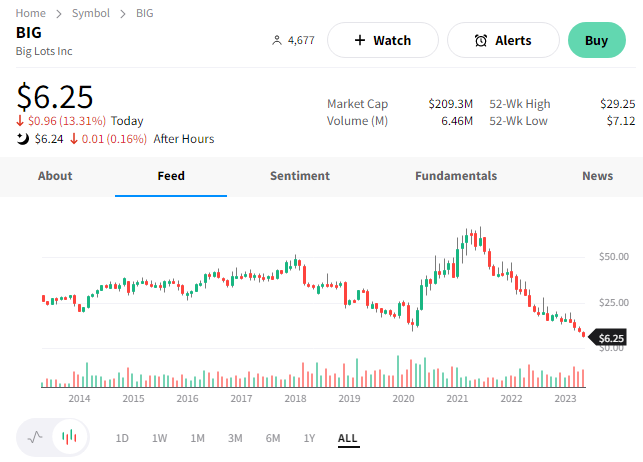

Big Lots is throwing it back to the 1990s with its share price. The downside move comes after the discount furniture retailer posted losses that nearly doubled analyst estimates. 😮

Here’s how its primary metrics shook out vs. expectations:

- Adjusted loss per share of $3.40 vs. $1.78

- Revenues of $1.12 billion vs. $1.19 billion

- Same-store sales decline of 18.3% vs. 13.2%

The lower-income consumer, which makes up most of the company’s customer base, continues to face several challenges: inflation biting into their discretionary income, receiving lower tax refunds, and higher interest rates on larger purchases. These factors and overall economic uncertainty caused many customers to pull back spending. 🛑

Adding to the issues were furniture product shortages, particularly as the company’s largest vendor abruptly closed in November. Unfavorable weather conditions also hurt seasonal lawn and garden sales, though hopefully, some of that will be made up in the current quarter.

To entice consumers, the company increased promotional activity, which pushed its gross margin from 36.7% last year to 34.9% today. Also, the value of the inventories on its books fell by 18.8%. 🔻

The company’s current situation is dire, and executives are aware of that. So to avoid becoming the next Bed Bath & Beyond story, they’re taking drastic measures to preserve the liquidity they’ll need to get their core business back on track.

That starts with suspending the company’s dividend and monetizing assets worth roughly $340 million. Additionally, they’ve raised their 2023 cost-cutting target from $70 million to over $100 million and identified opportunities to cut more than $200 million over the next eighteen months. ❌

Executives opted not to provide full-year guidance, citing the “significant macroeconomic uncertainty,” but said they expect sales and gross margins to improve in the year’s second half. That’s similar to comments from other retailers like Best Buy. However, they forecasted a same-store sales decline in the “high-teens” percentage range for the second quarter. That was well beyond the analyst consensus view of an 8.6% decline. 🔮

In the face of all these issues, executives say they’re “highly encouraged by the green shots we are seeing.” Moreover, they reiterated that the steps being taken today would position them well for when the macroeconomic environment ultimately turns more favorable.

However, much like the company’s customers, investors aren’t quite buying what they’re selling. The only shoots they see are the parachutes they’re jumping out of the stock with. 🪂

Bad jokes aside, $BIG shares fell 13% to their lowest level since 1991. 👎