Earnings season has slowed to a crawl, but let’s quickly summarize some of today’s movers. 👇

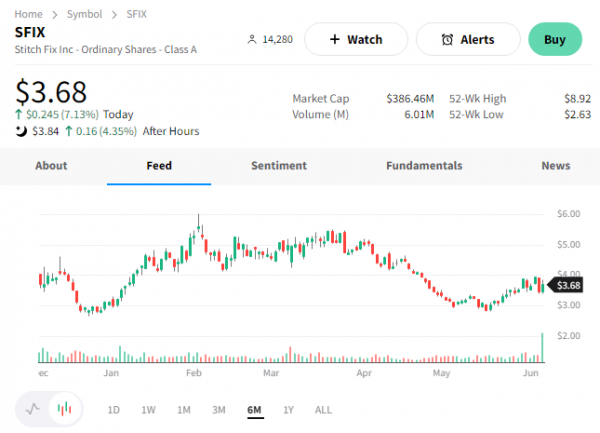

First up is the online personal styling service, StitchFix. Investors continue to look for signs of a turnaround in the stock, which continues to tread water near all-time lows after falling 98% from its pandemic-fueled highs.

Its third-quarter adjusted loss per share of $0.19 on $394.9 million in revenue both topped analyst estimates. Active clients of 3.48 million also beat the 3.45 million expected. However, the company’s fourth-quarter sales forecast of $365 to $375 million fell short of the $379 consensus view. 🔺

Overall, the company remains pressured by the current environment, with all client cohorts spending less than prior years. As a result, it’s focused on cutting costs and is scaling back operations to focus solely on its U.S. business. 🛒

$SFIX shares gained another 4% after hours on the news. 👍

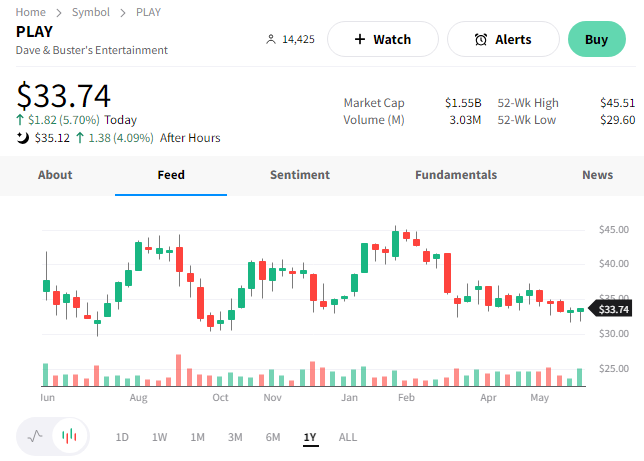

Dave & Buster’s Entertainment reported higher revenue than last quarter, indicating that consumers continue to spend on events and experiences.

The company’s adjusted earnings per share of $1.45 on revenues of $597.3 million topped the $1.26 and $451.1 million estimates. Executives believe in the company’s long-term value proposition, buying back $200 million of common stock in fiscal 2023, reducing outstanding shares by ~12%. 💪

$PLAY shares rose an additional 4% after the bell.

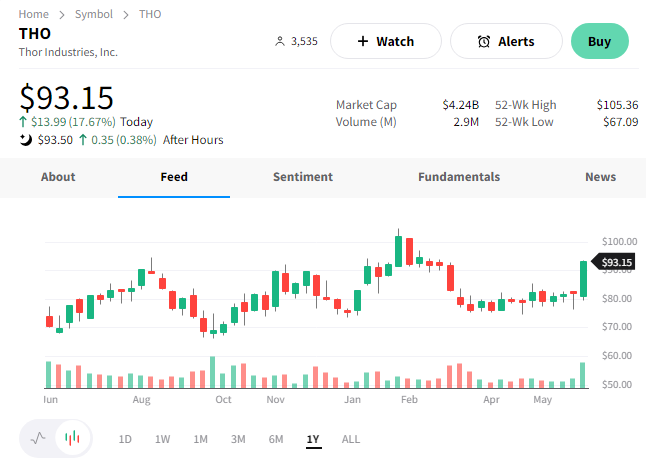

Last up is Thor Industries, which soared today, and inspired this article title. 🤷

The RV maker still sees macroeconomic challenges in the short term, narrowing its full-year guidance. However, its third-quarter results topped estimates, with adjusted earnings per share of $2.24 on revenues of $2.93 billion.

Executives say they’ve “rightsized” inventory and product offerings for current customer preferences. That, combined with cost-cutting, has allowed the company to weather the weak global economic conditions. Higher prices, strong demand, improved inventory availability, and operational initiatives in Europe drove this quarter’s strength. 🌍

The company now anticipates $10.5 to $11 billion in sales, generating adjusted earnings per share of $5.80 to $6.50 in fiscal 2023.

$THO shares jumped 18% on the day. 📈