Electric vehicle stocks are in the news, this time with China-based maker Nio making headlines. 📰

The company reported $1.55 billion in revenues, up 7% YoY. However, vehicle sales revenue was down 0.2% YoY, and total revenues were well below consensus estimates. The company’s product mix for the quarter was focused on lower-priced Et5 and 75 kWh standard-range battery packs. That, combined with pricing competition in China, drove the top-line miss.

Pricing pressures were partially offset by an increase in delivery volume (+20.5% YoY) of 31,041 vehicles. However, its cost of sales jumped 24.2% YoY, outpacing revenue by 3.5x and pushing gross margins down to a meager 1.5%. 📉

Net losses of $707.6 million were up nearly 300% YoY, though adjusted losses came in better than anticipated.

The company expects second-quarter deliveries of 23,000 to 25,000 vehicles, a double-digit YoY decline. Its revenue expectation was also half the consensus estimate at roughly $1.3 billion. 😬

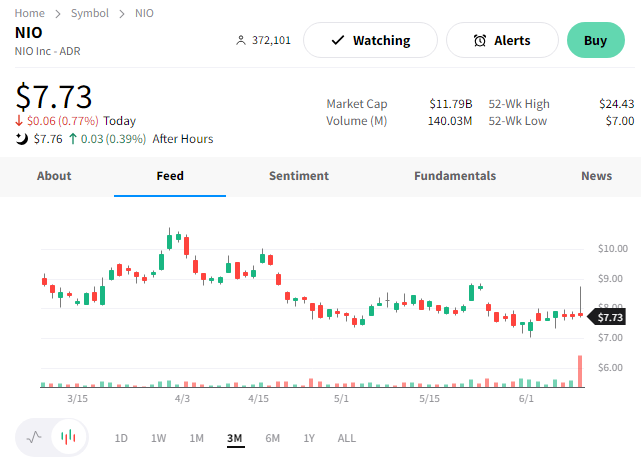

$NIO shares had a volatile day on the news. They fell 6% pre-market, then rose with the Nasdaq at the open, but faded to close down about 1%. 👎