Multinational software company Oracle hit new all-time highs following an analyst upgrade and stronger-than-expected earnings. 👍

The company reported adjusted earnings per share of $1.67 vs. the $1.58 expected. Recent cost-cutting efforts and improving margins helped buoy its bottom-line results.

Revenues of $13.84 billion also topped the $13.74 billion analyst estimate. They broke down like this:

- Cloud services and license support revenue +23% YoY to $9.37 billion

- Cloud licenses and on-premises revenue -15% to $2.15 billion

- Cloud infrastructure revenue +76% YoY to $1.4 billion

Though its cloud infrastructure revenue is much smaller than its peers, it’s growing much faster. Analysts say that should continue to help the company’s overall gross margin. ⛅

Additionally, CTO Larry Ellison said Oracle will introduce a generative artificial intelligence cloud service tied to a partnership with startup Cohere, which will use Oracle’s cloud infrastructure.

Looking ahead, the company expects fiscal first-quarter adjusted earnings per share of $1.12 to $1.16 and 8% to 10% revenue growth. Revenue growth topped estimates, while earnings were essentially in line with expectations. 🔮

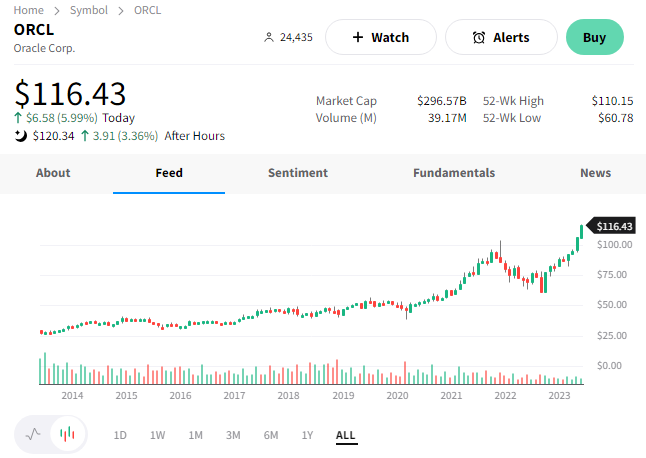

$ORCL shares were up 6% before earnings and added another 3% after hours. They’re sitting at new highs above $120. 🤩