Global transportation company FedEx is falling after reporting weaker-than-anticipated fourth-quarter results. 🔻

Its adjusted earnings per share of $4.94 topped the $4.85 analyst estimate. The company continues to struggle with cost inflation but has spent most of the last year drastically cutting costs, leading to an $800 million (15%) increase in operating profit vs. the fiscal year 2022. ✂️

However, revenues of $21.9 billion were down about 10% YoY and missed the $22.55 billion expected by Wall Street. Executives blamed a “dynamic demand environment,” where daily package volumes in its Express business fell 10% YoY and average daily freight pounds shipped dumped 14% YoY. 📦

The company expects to realize about $4 billion in profit-margin improvements from its DRIVE program by the end of fiscal 2025, though roughly half of that was realized last year.

Looking ahead, it forecasts fiscal-year sales to be flat or experience low single-digit growth and earnings per share of $16.50 to $18.50. It also earmarked $5.7 billion in capital spending, primarily for investments to improve efficiency and lower long-term costs. And lastly, after eighteen years with FedEx, CFO Mike Lenz announced his retirement on July 31. His replacement is TBD. 🔮

Overall, executives believe the economic environment remains uncertain. Clearly, based on their forecast and operational priorities, they’re expecting lean demand and upward cost pressures to stay for the foreseeable future.

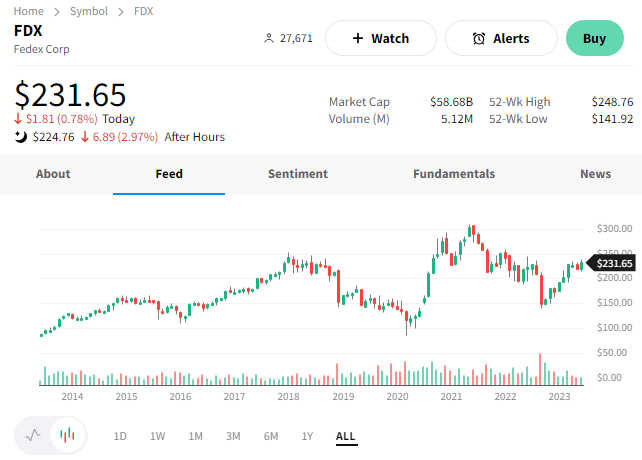

With $FDX shares up 50% since their September lows, today’s news wasn’t enough to get it going. The stock initially fell as much as 8% after the bell but settled down around 3% as of writing this. 👎