Unlimited breadsticks and salad were not enough to keep consumers returning to Olive Garden’s parent company at the rate Wall Street expected. Let’s break down how the company’s brands performed in the current environment and what executives say about the future. 👇

First, Darden Restaurants reported adjusted earnings per share of $2.58 on $2.77 billion in revenues. Those earnings topped expectations by $0.04, while revenue was in line.

Net sales rose 6.4% YoY, while same-store sales rose 4% YoY. Leading the charge was LongHorn Steakhouse, which saw 7.1% same-store sales growth, topping the 4.9% expected. 🔺

However, Olive Garden, which makes up about half of the company’s sales, reported 4.4% growth, missing expectations by 0.6%. And its fine dining segment, including The Capital Grille and Eddie V’s, saw same-store sales decline 1.9% YoY. The company anticipates softer fine-dining sales will continue through the first fiscal quarter. 📉

Executives blamed high comps from last year for this quarter’s softer-than-expected numbers. They anticipate traffic will stabilize on a YoY basis after the fiscal first quarter, as trends settle down from post-pandemic peaks and establish new normal levels.

Looking ahead, executives forecasted $8.55 to $8.85 adjusted earnings per share for fiscal 2024, straddling the consensus view of $8.79. They also anticipate $11.5 to $11.6 billion in sales and same-store sales growth of 2.5% to 3.5%. 👎

On the costs front, they anticipate 3% to 4% total inflation, which they will offset by raising menu prices by 3.5% to 4%. And they’re looking at $550 to $600 million in capital expenditures (CAPEX) in the coming fiscal year.

While executives downplayed the impact of the macroeconomic uncertainty and sticky inflation, investors are worried about the demand side of the equation. 😟

If most restaurants and food companies continue raising prices to offset rising costs, how will that affect the volume of consumers? We’ve already seen many consumers trading down as inflation bites their wallets, and the Olive Garden same-store sales confirm that to some degree.

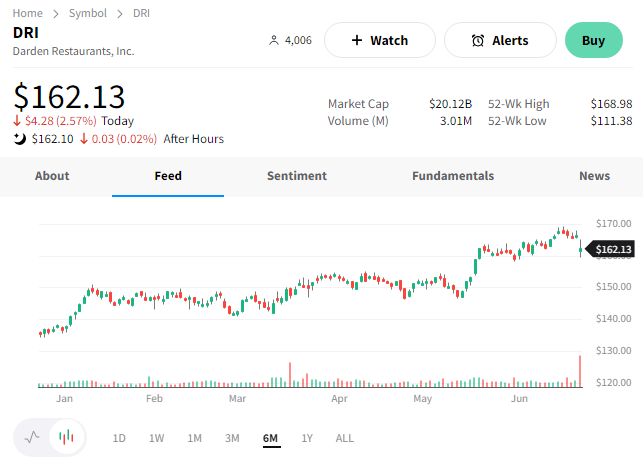

We’ll have to wait and see. But for now, $DRI shares are pulling back slightly from the all-time highs set last week. 🔻