The sneaker and apparel company reported its first earnings miss in three years as margin pressure reduced profits. 😬

Nike reported adjusted earnings per share of $0.66 vs. the $0.67 expected. Revenues of $12.83 billion topped the expected $12.50 billion.

Unfortunately, the company could not progress on reducing its bloated inventory levels, with them coming in flat YoY at $8.5 billion. Gross margins fell again this quarter, dropping 1.4 percentage points to 43.6%. Driving that decline was higher product input costs, elevated freight and logistics expenses, greater promotional activity, and unfavorable currency exchange rates. 🔻

Additionally, the company has focused on the wholesale sales channel to help clear out inventory. That lower-margin sales channel weighed on the margins, still accounting for about 56% of the company’s total sales. However, sales through NIKE Direct continue to accelerate, rising 14% YoY and accounting for roughly 44% of total sales. 📦

Selling and administrative expenses were up 8% YoY to $4.4 billion. Operating overhead costs rose 10% YoY to $3.3 billion, while demand creation expenses increased 3% YoY to $1.1 billion.

On a positive note, Nike’s sales in China rose 16% YoY, albeit from low comparables due to the country’s lockdowns last year. Like other retailers, it has seen mixed results in China following its reopening, raising questions about the country’s ability to drive growth and offset North America’s weakness. 🌏

Overall, it remains a challenging environment for the company. Strong earnings were the company’s saving grace when demand waned, but may now be a headwind until margins improve.

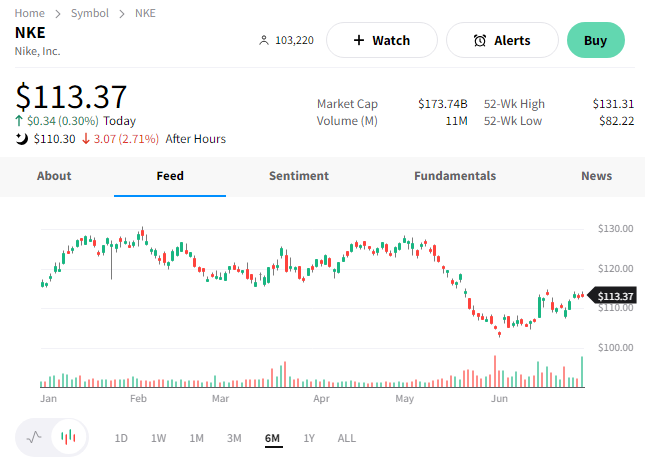

$NKE shares fell about 3% after the bell. 👎