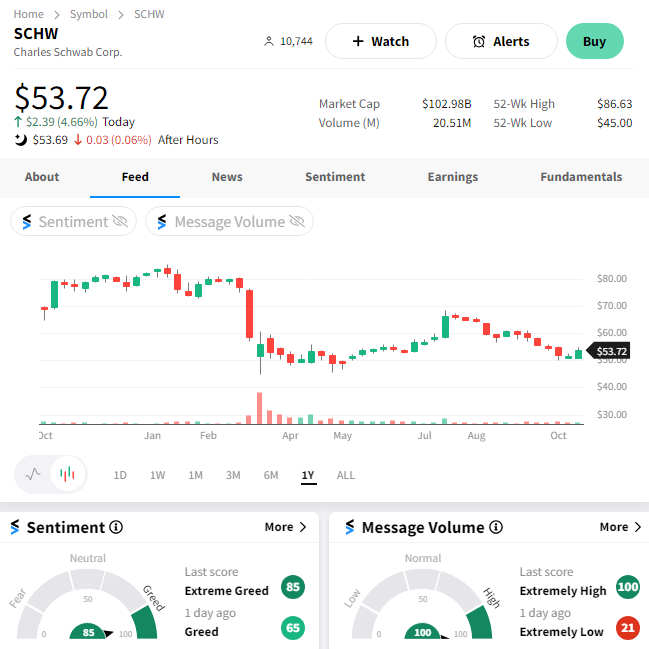

Charles Schwab and its peers got caught up in the regional banking crisis earlier this year, as higher interest rates and depositor uncertainty caused a flight of cash away from smaller players in the space. The stock quickly fell 50% from its January highs and has struggled to recover since. 😰

So, let’s analyze today’s earnings report to see if the future looks any brighter for shareholders. 👇

First up, the brokerage giant saw third-quarter adjusted earnings per share of $0.77 vs. the $0.74 expected, but down from $1.10 a year ago. Revenues fell 16% YoY to $4.6 billion, missing analyst expectations. Full-year revenues are expected to be down 8% to 9% YoY.

The primary issue the company is facing is “cash sorting,” which is a process in which customers move uninvested cash from low-paying bank accounts to higher-paying options like high-yield savings accounts or money-market funds. 💸

The rapid flight of deposits over the last year has led to severe issues with its liquidity management. As a result, it’s had to rely on costly funding sources like Federal Home Loan Bank borrowings to fill any gaps that emerged. Net interest revenue fell 24% YoY to $2.2 billion, primarily due to these higher interest expenses. And bank deposits fell roughly 29% YoY to $284.4 billion.

However, executives say that pressure is beginning to wane, with FHLB borrowings falling roughly 25% QoQ and September bank sweep deposits rising MoM for the first time since March 2022. With that said, they did warn that they will likely issue more debt to shore up liquidity and achieve their goal of paying down short-term borrowings. 💰

Additionally, the company is still feeling the knock-on effects of migrating TD Ameritrade customers. Net new assets fell throughout the summer, but executives expect attrition will taper off soon as those TD advisors and clients who wanted to leave probably did before Labor Day weekend when Schwab officially migrated $1.3 trillion in assets from TD Ameritrade to its own platform. 🖨️

CEO Walt Bettinger said on the company’s earnings call, “I understand that the overall backdrop is decidedly negative and that, for some, it is easier to focus on the near-term challenges. But I would encourage you to look at the entirety of our position.”

Reading between the lines, investors appear to think the worst is behind Schwab but that it’s not out of the woods yet. The external factors making this a challenging quarter and year still exist, but the company is changing its approach and trying to manage its operations more effectively.

Despite the cautious undertones, $SCHW shares popped 5% as investors cheered the better-than-anticipated drop in bank deposits and improving outlook. 👍