The Swedish music streaming giant has successfully squeezed its way back to profitability after overexpanding during the pandemic. Let’s take a look at its third-quarter results and why the stock is popping. 👀

Earnings of 33 euro cents per share beat the 22 euro cents expected, while revenues of 3.36 billion euros topped estimates by about 1%. Premium subscriber numbers also surprised to the upside, at 226 million vs. 224 million anticipated.

Partially driving the 11% YoY revenue growth was the company’s price increases from earlier in the year, with monthly bills going up $1 to $2, depending on the plan. Luckily, the company saw minimal impact on churn levels, suggesting they may have more room to raise prices in the future. Additionally, ad-supported revenue rose 16% YoY to 447 million euros. 🔺

It’s also hoping its audiobook push, which will offer subscribers access to more than 150,000 titles, will drive its value proposition. The new product feature could help drive additional premium subscriptions and enhance its ability to raise prices again. 📚

On the costs side, lower marketing spending and personnel costs helped drive this quarter’s profit. Like its peers, the company had to “right size” itself as growth slowed after the pandemic, but it now feels it’s in a better spot operationally. 📊

CFO Paul Vogel called the quarter “an inflection point,” saying he expects profitability to continue into the fourth quarter and into 2024.

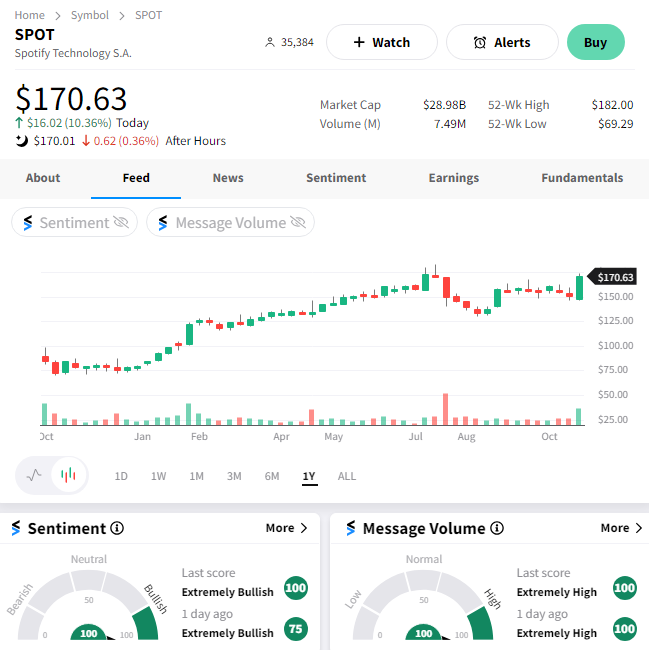

$SPOT shares rose 10% on the day, looking likely to challenge their year-to-date highs in the coming days. With the stock up more than 100% year-to-date, investors will be looking for the next catalyst to drive further gains. 🕵️♂️