Mark Zuckerberg continues to flex after Meta delivered another top-and-bottom-line beat. 💪

Revenues rose 23% YoY, their fastest since 2021, to $34.15 billion. That topped estimates of $33.56 billion, as did earnings per share (EPS) of $4.39 vs. $3.63 expected. 📊

As for other metrics, investors honed in on the following user numbers:

- Daily active users (DAUs): 2.09 billion vs. 2.07 billion expected

- Monthly active users (MAUs): 3.05 billion (as expected)

- Average revenue per user (ARPU): $11.23 vs. $11.05 expected

The third quarter reiterated that Meta’s ad business is rebounding better than its competitors after declining for three straight quarters last year. And it expects that strength to continue, forecasting revenue of $36.5 to $40 billion for the fourth quarter, straddling the consensus view of $38.85 billion.

But overall, the tech giant’s “year of efficiency” continues to pay dividends. The company’s headcount is down 24% YoY to 66,185, helping drive total expenses down 7% YoY to $20.40 billion. Looking ahead, executives reduced their total expense outlook for 2024 to $87-$89 billion from $88-$91 billion. And for fiscal 2024, it’s forecasting $94 to $99 billion in total expenses. 🔻

As for Meta’s Reality Labs division, the company expects the unit’s operating losses to rise meaningfully YoY due to ongoing product development efforts in augmented/virtual reality and scaling its ecosystem. With that said, as long as the rest of the business continues humming along, investors are happy to make this long-term bet along with Zuckerberg.

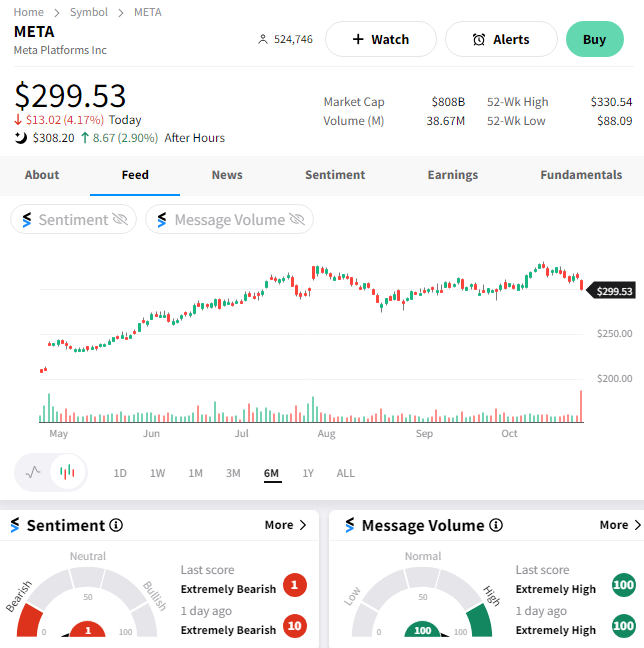

$META shares are volatile after hours but are currently up ~3%. 🔺