The retailer behind popular footwear brands like UGG and HOKA, Deckers Outdoor, continues to delight investors. 👍

It reported adjusted earnings per share of $6.82, topping the $4.43 expected by analysts. Revenues of $1.09 billion also topped the $960.5 anticipated. That represents 25% YoY revenue growth and a 79% YoY increase in earnings. 📈

Driving the record results was strong consumer demand for its HOKA and UGG brands. Analysts say the company’s inventory management and product mix were positioned well, while engaging marketing campaigns helped differentiate its brands in a competitive space.

Gross margins expanded from 48.2% to 53.4%, with direct-to-consumer (DTC) net sales rising 36.8% YoY vs. 19.4% YoY for its wholesale channels. SG&A expenses did rise due to additional marketing spend, but it’s helping the company drive additional market share gains. 🛒

Here’s how it’s individual brand sales fared on a YoY basis:

- UGG +28.1% to $610.5 million

- HOKA +27.3% to $424 million

- Teva +28.4% to $21.5 million

- Sanuk +28.5% to $5.4 million

- Others (primarily Koolaburra) +7.2% YoY to $30.6 million

Additionally, the company’s cash and cash equivalents essentially doubled YoY to $823.1 million, with inventories falling about 20% to $726.3 million. 💰

Executives expect the strength to continue through the holiday season, raising their fiscal 2024 revenue forecast from $3.98 to $4.03 billion and earnings estimates to $22.90-$23.25 per share.

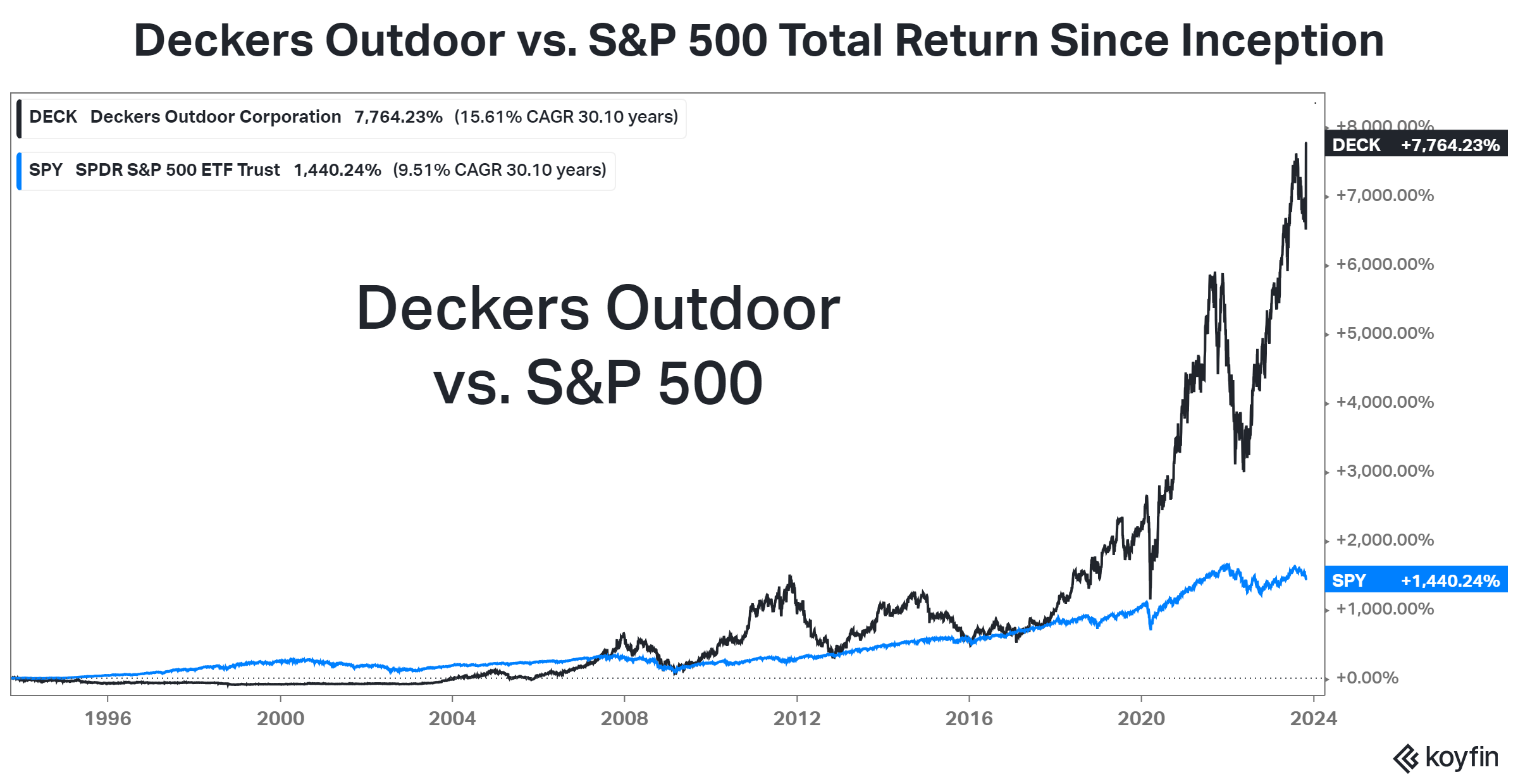

$DECK shares rose 19% today to fresh all-time highs, with its total return since inception climbing to nearly 7,800%. 🤩