It was a rough day for New York-based airline JetBlue, with its shares sinking to a 12-year low. 🛬

The airline posted a third-quarter adjusted loss per share of $0.39 on revenues of $2.35 billion, missing expectations of $0.25 and $2.38 billion. Executives blamed a challenging operational backdrop, citing increased air traffic control and weather-related delays. 📊

Looking ahead, JetBlue increased its fourth-quarter and full-year adjusted loss guidance. Rising fuel and other costs, along with slowing domestic travel prices and demand, have been a double-whammy for the airline. As a result, it’s reducing or eliminating some schedules as the industry struggles with overcapacity.

Meanwhile, Spirit Airlines said it will have little to no capacity growth next year as slower demand and a Pratt & Whitney engine issue weigh on results. As a result, it’s pausing new-hire flight attendant and pilot training next month, cutting costs to weather the storm better. ✂️

Overall, anxiety remains high around the JetBlue-Spirit merger. It would be the first major U.S. airline combination since 2016 when Alaska and Virgin America came together. With the Biden Administration focusing heavily on anti-trust cases, the Justice Department has alleged the proposed transaction will increase fares and reduce consumers’ choices. They’re concerned most with the lower-income (budget) travelers, who will likely be impacted most. 🧑⚖️

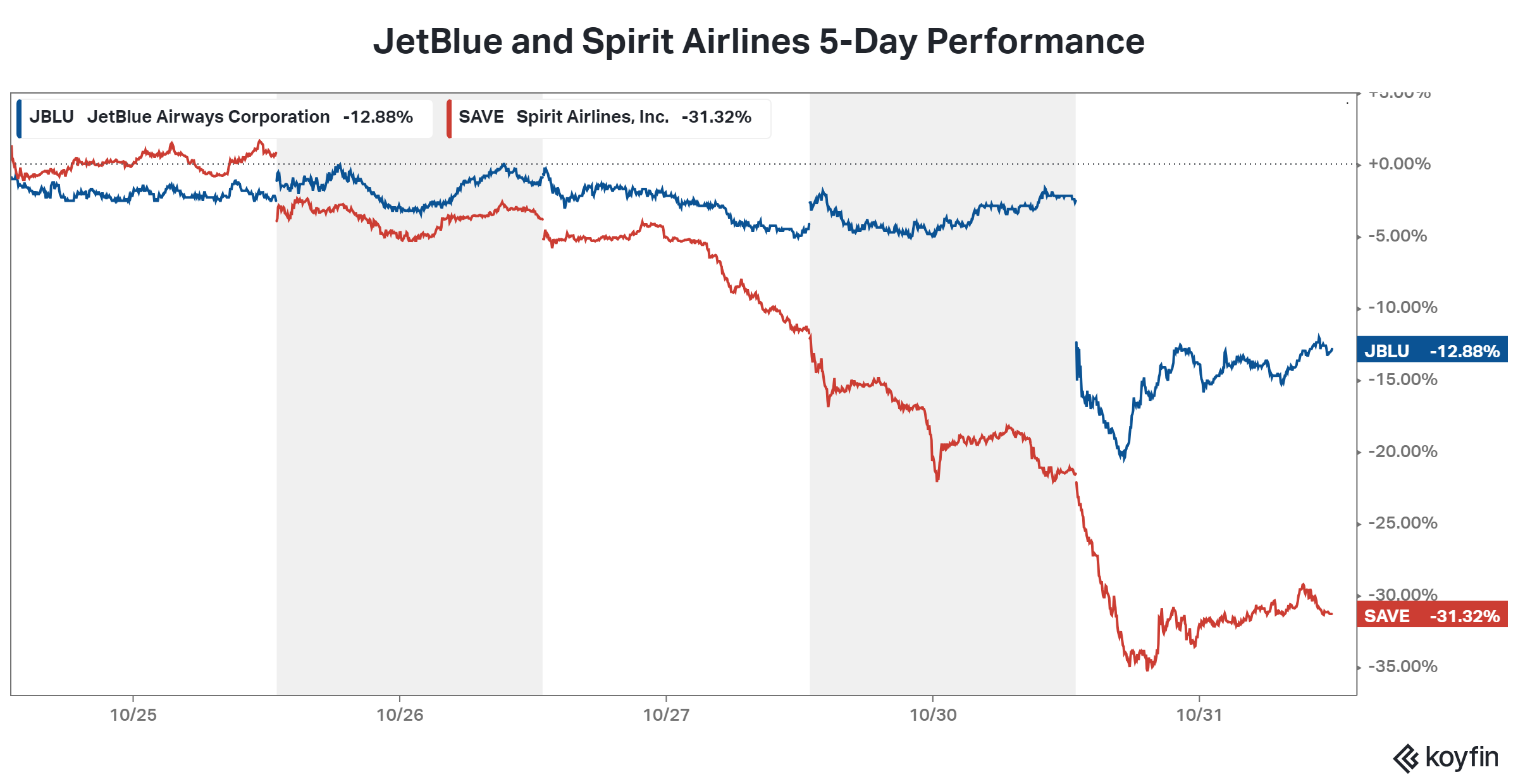

The trial began today and is expected to take three weeks, though it could extend through December 5th. The earnings news and trial starting jolted both stocks, with $JBLU and $SAVE falling sharply over the last five days. 📉