Cathie Wood and her ARK funds are experiencing some relief as beaten-down technology stocks they’ve bet on rebound. 😌

So what’s causing these stocks to catch such a strong bid recently? Most analysts believe it’s a combination of several factors:

- The bond market stabilizing (rates pulling back)

- Earnings results going from “very bad” to just “bad”

- Positioning in the stocks being extremely pessimistic

- Portfolio managers looking for “catch-up” plays into year-end

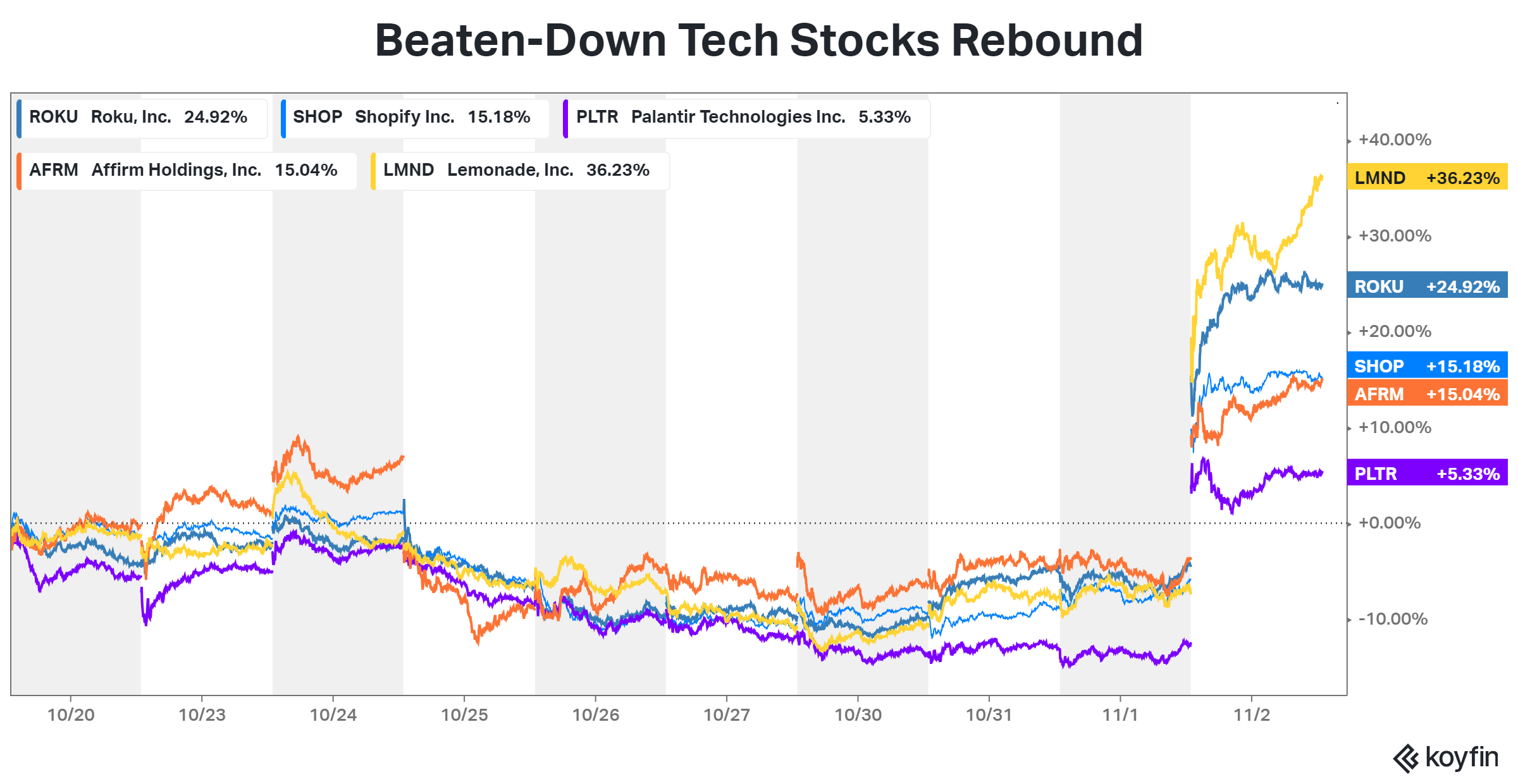

The ten-day performance chart shows several of $ARKK’s most significant holdings jumping sharply today following their earnings reports. However, it also shows the extent of their recent declines and overall volatility. 📊

Other positive earnings reactions included Coinbase, Block, and DraftKings, which all soared after the bell. However, not every stock in this category is seeing a bounce. For example, $BILL plunged 35% and $FTNT fell 18% following their weaker-than-expected results, as volatility among growth stocks continues. 😬

We’ll have to wait and see if these conditions persist. But for now, Cathie Wood and investors and traders following similar strategies are feeling relief. 👍