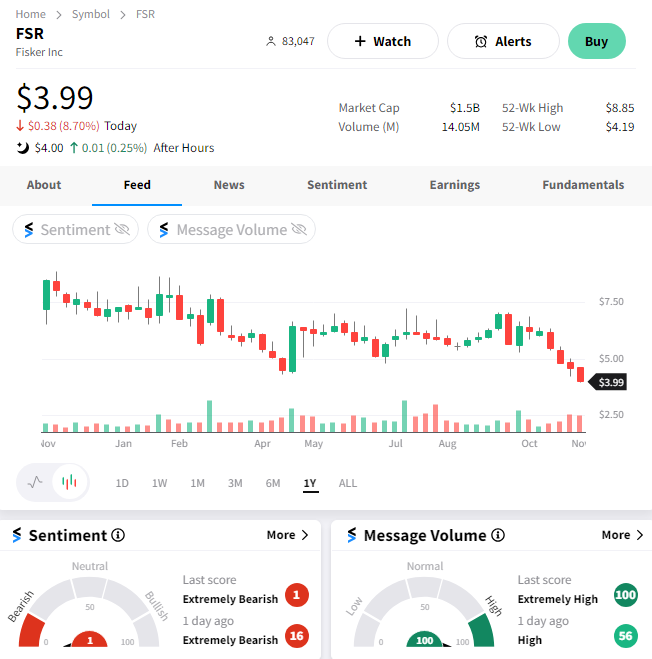

Electric vehicle startup Fisker had another rough day after pushing its third-quarter earnings release to Monday, Nov. 13. 🗓️

The company said, “The timing of the appointment of a new chief accounting officer effective Nov. 6, 2023, and the departure of the former chief accounting officer effective Oct. 27, 2023, has delayed the completion of the financial statements and related disclosures.” The unexpected delay caused more anxiety among already concerned investors, sending shares down 8%. 😬

Coincidentally, the stock also fell 8% when it reported second-quarter results in August.

Back then, investors’ concerns about the company’s ability to sustainably produce its vehicles at scale weighed on the stock. Especially since it cut its full-year production guidance again. Collectively, those concerns offset a positive gross profit margin of 7.5% (or 18.5% excluding discounted early-stage investor deliveries) and a narrower-than-expected loss. 📊

The market anxiously awaits an update on its recent production and deliveries, wanting to see a significant ramp-up in both numbers. For now, $FSR shares are sitting at all-time lows as the broader electric vehicle industry challenges continue to grow. 😨