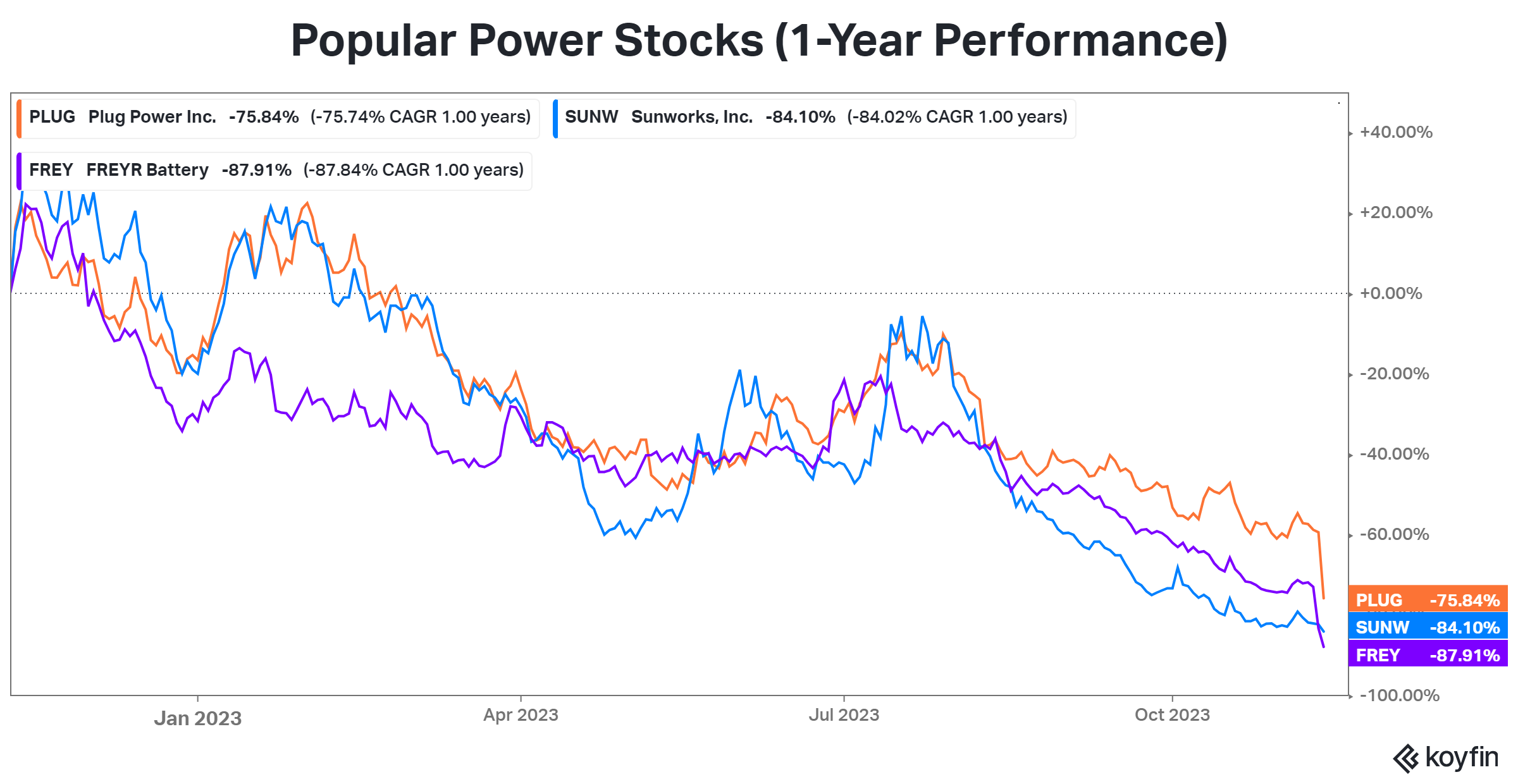

It’s Friday, and we’re all running on empty, but we wanted to highlight three power stocks that took a beating today. 😱

First up is Plug Power, which had its worst day over nine years. The hydrogen technology company issued a warning about its financial position during its third-quarter earnings release. Although its current revenues and fourth-quarter forecast aligned with expectations, it said it was hit by “unprecedented supply challenges.”

The hydrogen shortages are driving up already inflated costs, causing it to need additional funding to boost its liquidity until the hydrogen market rebalances. While the management said it has confidence it will execute a liquidity transaction soon and improve margins throughout next year, several analysts believe it’s not worth the risk and downgraded the stock. 👎

It appears too much is riding on the government, with Plug pursuing a potential loan from the Department of Energy worth $1.5 billion. It’s also awaiting guidance about a planned tax credit for hydrogen production in the U.S. As with everything government-related, things take time, which the company doesn’t have the luxury of. $PLUG shares plummeted 40% today. 📉

Battery-cell developer FREYR Battery also renewed liquidity fears among investors after saying that it was “rightsizing the organization” as part of a broader cost-savings program. It’s hoping to cut its cash burn rate by 50%, improving its projected liquidity runway to more than two years.

The company is now minimizing spending on its Giga Arctic Facilities in 2024, instead focusing on the continued development of technology at its Customer Qualification Plant. $FREY shares fell 28% on the day to new all-time lows. 🪫

Lastly, commercial solar power solutions company Sunworks continues to struggle in the current environment. The company’s third-quarter loss of $0.24 per share was in line with expectations, but revenue was down 30% YoY and well below analyst expectations. $SUNW shares fell 10% and made new all-time weekly closing lows on the news. 🌦️