While investors are primarily focused on retailer earnings this week, they can’t escape the volatility that comes with tech earnings. Let’s quickly recap what we heard from two tech giants. 📝

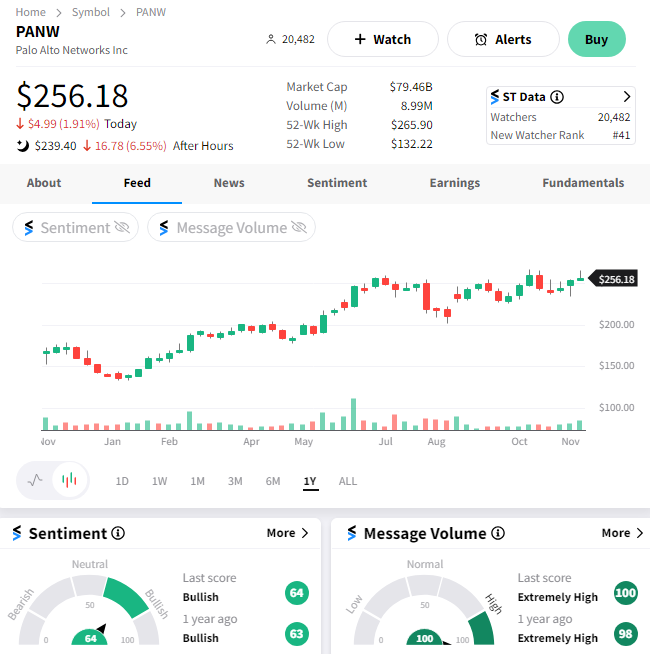

First up, cybersecurity firm Palo Alto Networks saw its first-quarter revenues jump 20% YoY to $1.88 billion. Meanwhile, adjusted earnings of $1.38 topped expectations of $1.16.

Executives say an unprecedented level of attacks is fueling strong demand in the cybersecurity market, but that higher cost of funds is offsetting or delaying some demand. As a result, its second-quarter billings guidance of $2.34-$2.39 billion fell short of the $2.43 billion consensus estimate. 🛡️

$PANW shares continue their pullback from all-time highs, falling about 7% after the bell. 🔻

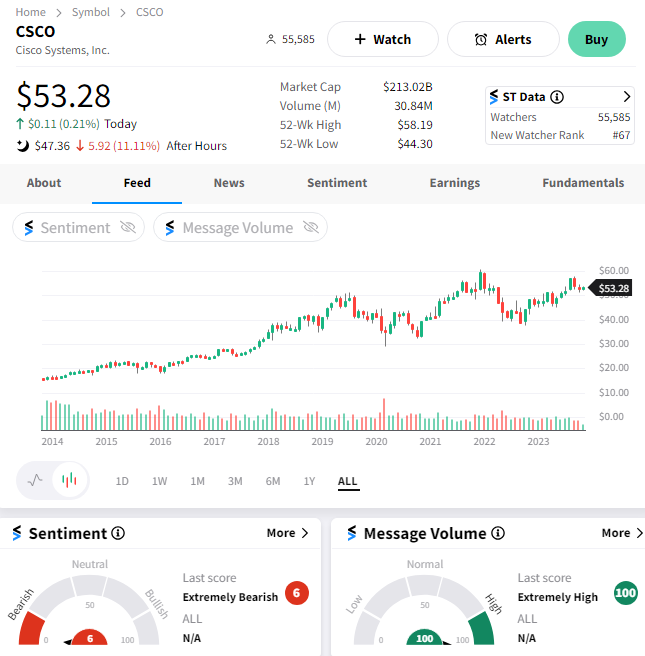

Networking, cloud, and cyber company Cisco also dropped after its guidance fell short of expectations. 👎

The company’s adjusted earnings per share of $1.11 on $14.67 billion in revenues both topped estimates. Like other tech companies, Cisco raised its full-year earnings guidance but reduced its revenue guidance.

Executives said new product orders slowed during the quarter as clients worked to install and implement products ordered in the three previous quarters. They anticipate that one or two-quarters of shipped products are waiting to be implemented, which could reduce (or at least delay) future orders. 🗓️

For now, Cisco remains focused on cost management to buoy earnings until demand rebounds. But the lackluster revenue guidance was enough to tick off investors, who are sending $CSCO shares down 11% after hours. 📉