Yesterday, some better economic news and strong results from JD.com put Chinese stocks back on the map. Today, they stayed on the map but went in the opposite direction. 🙃

Driving the news was Alibaba’s earnings report, where the company revealed some unnerving news for investors. Although the company had a pretty good quarter that beat earnings and revenue expectations, it said it’s canceling its cloud unit spinoff because of geopolitical tensions.

That will prevent it from unlocking significant shareholder value, reducing one of the key value propositions investors had touted. There’s a belief among Wall Street and management that the company would be worth more as a holding company than as a conglomerate, which is why it outlined plans to break into six separate entities last March. 📝

However, management warned in October that U.S. export controls on advanced computer chips “may materially and adversely affect Cloud Intelligence Group’s ability to offer products and services and to perform under existing contracts.” Those fears came to fruition, creating an uncertain future for the company and investors as it navigates a fluid geopolitical environment.

It’s the first major causality of the growing tensions between China and the U.S. (and other Western countries). While other companies have seen an impact, this is by far the most material impact a public company has experienced. 🫢

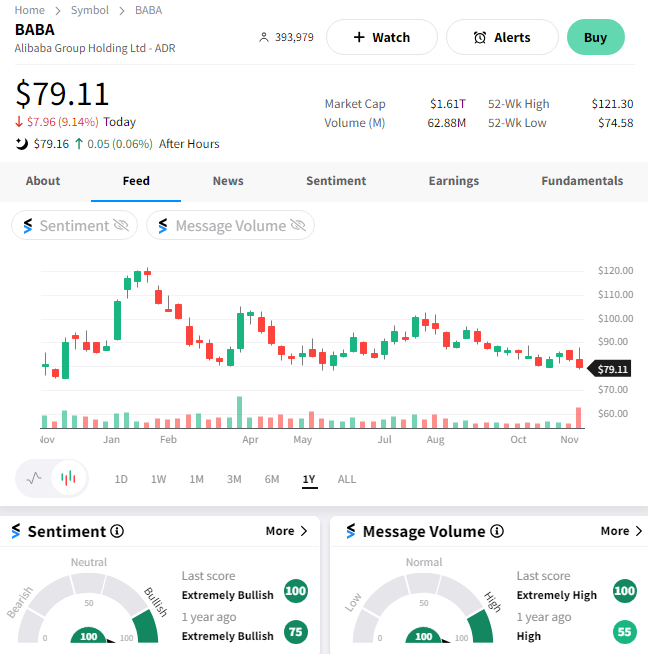

$BABA shares fell 9% towards 1-year lows on the news. Currently, the community looks interested in “buying the dip,” with message volume high and sentiment reading extremely bullish. 📉

Additionally, news broke after the bell that semiconductor equipment maker Applied Materials is facing a U.S. criminal probe for its shipments to China. While there are few confirmed details about the situation so far, the news overshadowed its earnings and revenue beat, sending $AMAT shares down about 7%. 🕵️♂️

With the Asia-Pacific Economic Cooperation (APEC) summit in California wrapping up, there’s been little progress between President Joe Biden and China’s Xi Jinping. However, the two promise to keep talking. So we’ll see where that goes… 🤷

Given the uncertainty around this geopolitical situation, investors in Chinese stocks and those with significant exposure to the country will likely remain skittish. That’s despite a seemingly improving Chinese economic status, stronger earnings outlooks from some of the country’s most prominent players, and lower valuations than other emerging markets. 😬