Chipmaker Nvidia’s earnings were definitely this week’s most highly anticipated event. And as always, the market did its best to frustrate both bulls and bears after the report. 😠

The company reported adjusted earnings per share of $4.02 on $18.12 billion in revenues. That topped expectations of $3.37 and $16.18 billion. 💪

As for the breakdown, its data center revenue rose 279% YoY to $14.51 billion. Analysts had expected $12.97 billion. Executives said half the revenue came from cloud infrastructure providers like Amazon, while the other half came from consumer internet entities and large companies.

Meanwhile, its gaming segment’s revenues rose 81% YoY to $2.86 billion, beating the $2.68 billion expected. The professional visualization segment saw 108% YoY growth to $416 million, while its automotive segment rose just 4% YoY to $261 million.

While all of its segments are important, investors primarily focus on its data center business, given its role in supporting future technologies like artificial intelligence (AI). 🤖

Founder and CEO Jensen Huang said, “Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI … NVIDIA GPUs, CPUs, networking, AI foundry services, and NVIDIA AI Enterprise software are all growth engines in full-throttle. The era of generative AI is taking off.”

As a result of the era taking off, Nvidia expects $20 billion in fourth-quarter revenue, implying a 231% YoY growth rate. 📈

Despite the solid results and guidance, investors remain concerned about the potential implications of the U.S.’s export restrictions to organizations in China and other countries. Nvidia’s CFO Colette Kress said, “We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions.” 🚫

That matches similar commentary from Nvidia and others in the industry. For now, demand for high-tech chips remains so robust that it’s likely to outweigh supply for the foreseeable future. Geopolitical tensions remain a longer-term risk, but there are more than enough buyers for the company’s products in the short term. ⚖️

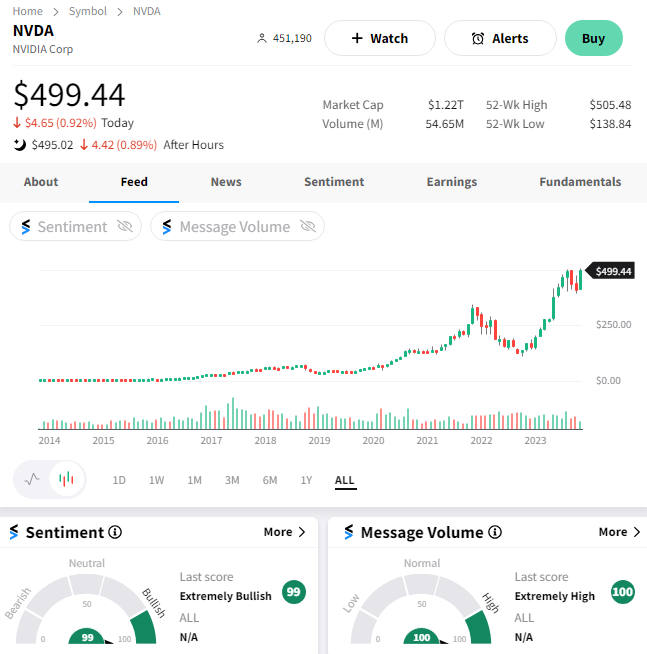

As for investors’ initial reaction, the bulls say this report and guidance validate the company’s massive growth potential. However, bears say the stock’s enormous runup since last year and sky-high valuation shows the business’ growth potential is already priced in.

Time will tell who is ultimately right long-term. But for now, only options premium sellers are happy, as $NVDA shares trade essentially flat after the bell. 🤷