The multinational industrial conglomerate Johnson Controls International was back on investors’ radars as its stock price remained out of control. 🫨

The maker of building heating systems reported a 3% YoY increase in sales to $6.9 billion. Fourth-quarter adjusted earnings per share of $1.05 was up 6% YoY. As for orders, they rose 9% YoY organically, and its record backlog of $12.1 billion was also up 9% YoY. 📊

CEO George Oliver said the company continues to post strong sales growth and margin expansion and is entering its new fiscal year with a record backlog. Strength in both its install and service businesses throughout this year shows the company’s value proposition, even in a challenging macroeconomic environment.

With that said, the company’s adjusted earnings guidance for fiscal 2024 missed estimates. It now expects $3.65 to $3.80 per share vs. the $3.92 consensus view. Organic sales growth of mid-single-digits is also likely, either inline or a slight downtick from current levels. 🔻

Overall, investors remain concerned that weakness in its Asia-Pacific region will continue due to China’s slow economic turnaround. Should its other markets continue to slow, that would weigh further on overall results. Hence, management used an optimistic but cautious tone.

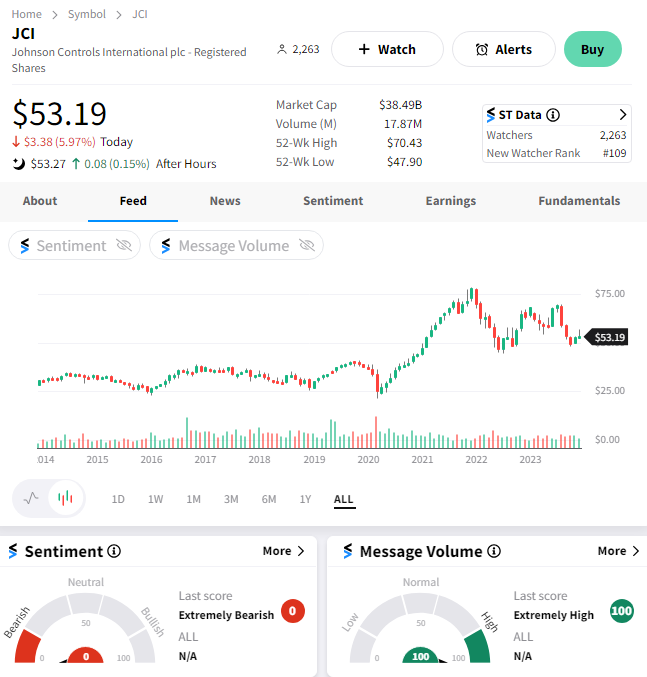

$JCI shares fell 6% on the day and are at the lower end of a three-year trading range. 📉