Software giant Adobe is the latest tech company to provide a weak revenue forecast. Let’s recap its results. 👇

The company’s fourth-quarter adjusted earnings per share of $4.27 topped analyst estimates of $4.13. Revenues grew about 10% YoY to $5.05 billion, narrowly exceeding the $5 billion anticipated.

However, a weak sales forecast caused investors to rethink their bullish thesis. Management expects $5.10 to $5.15 billion in revenues, below the $5.16 billion estimate. Its full-year guidance of $21.33 to $21.50 billion was also shy of the $21.73 billion expected. 👎

Analysts anticipated a blockbuster quarter after executives predicted “really strong” performance during their analyst day in October. And with the stock up about 80% since its May introduction of AI tools, there’s little room for error, even if management’s forecast was slightly off.

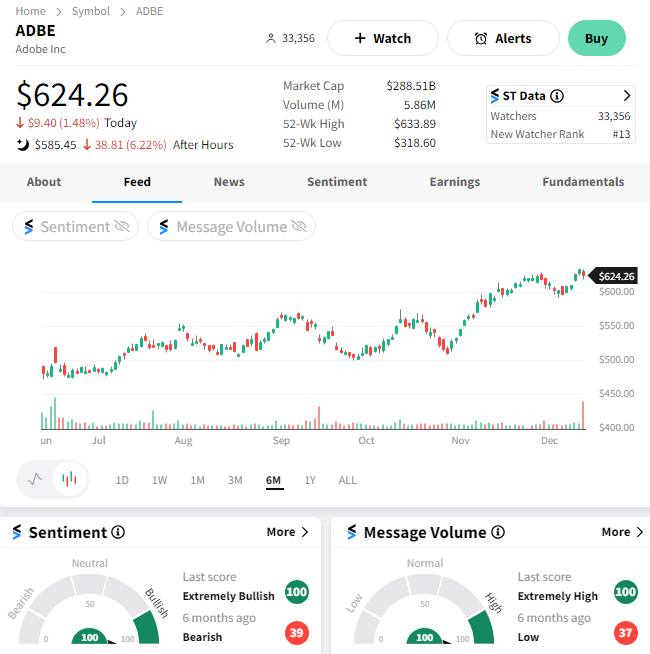

$ADBE shares fell 6% after hours. With that said, the Stocktwits community remains bullish, so we’ll have to see if investors buy the dip in the days ahead. 👀