The tech sector continues to lead the market higher, with those that can deliver strong results being rewarded handily by investors. 💸

Electronic supplier and manufacturer Jabil is the latest to beat first-quarter earnings and revenue expectations. Its adjusted earnings per share of $2.60 on $8.39 billion in revenues narrowly beat forecasts of $2.58 and $8.35 billion. 🔺

Executives saw a broad-based softening in demand during the last few weeks of the quarter, but the company was able to drive core margin growth through cost management. The weak demand environment has been telegraphed, so the market was happy to see its revenues fall about the same amount it expected.

Looking ahead, management remains cautious on demand but optimistic on earnings. Their fiscal second-quarter adjusted earnings guidance of $1.73 to $2.13 per share should easily top analysts’ $1.85 consensus view. 🔮

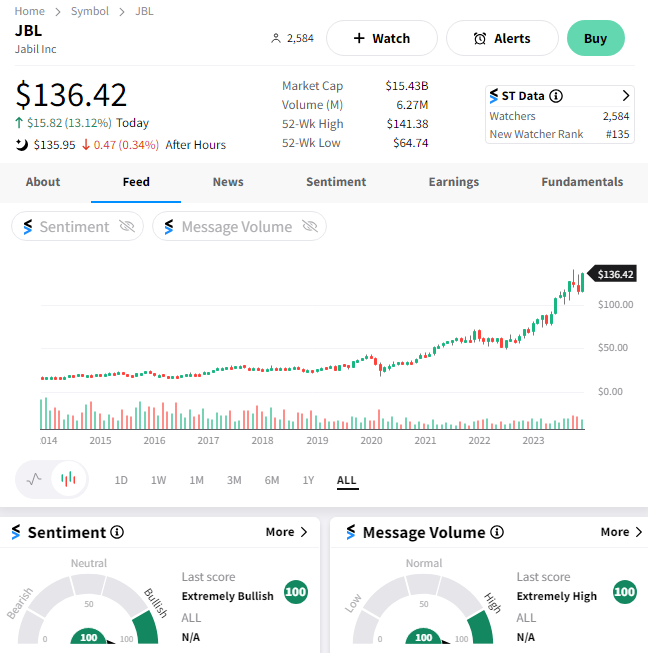

$JBL shares were up over 13% on the day as investors assessed the report.