Consumer packaged goods companies have been passing higher costs through to consumers by raising prices and/or shrinking package sizes. Given the tepid demand, pricing power was their primary way to grow revenues. But it appears that some companies are approaching (or have hit) the limit of what consumers are willing to tolerate. 🛑

General Mills is the latest company to share those concerns via its second-quarter results.

The company’s adjusted earnings per share of $1.25 was higher than last year’s $1.10 and consensus expectations of $1.16. However, sales declined 1.6% YoY to $5.14 billion, missing analyst estimates of $5.35 billion by a wide margin. 🔻

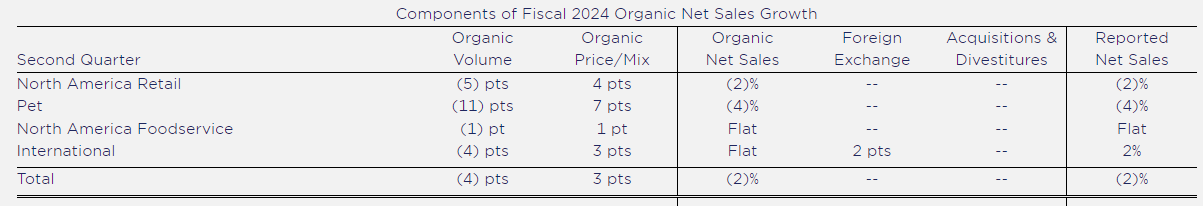

The chart below shows what drove the sales drop: volume declines in all of its categories, offsetting the small(er) price increases it tried to push through. Overall organic sales contracted 2% vs. Wall Street’s expectation for 3.1% growth. 📊

The message: consumers appear to be far more discerning in the current environment than they have been over the last two years. 🤔

In the absence of revenue growth, the company continues to focus on cost savings. CEO Jeff Harmening said, “While we saw slower-than-expected volume recovery in the second quarter amid a challenging consumer landscape, we generated bottom-line growth thanks primarily to strong HMM cost savings.’

Like several of its direct competitors and other consumer-related companies such as FedEx, it’s maintaining a cautious outlook for the rest of its fiscal 2024, with its CEO continuing, “For the full year, we’ve revised our topline outlook to account for a slower volume recovery…” It previously forecasted 3%-4% organic sales growth but revised it to a 0%-1% decline. 🔮

It also narrowed its adjusted earnings outlook from a 4%-6% range to 4%-5%. That said, the company’s efforts and focus are highlighted through its YoY increase in gross margin and operating profit, as well as a 90 bp decline in selling, general, and administrative expenses.

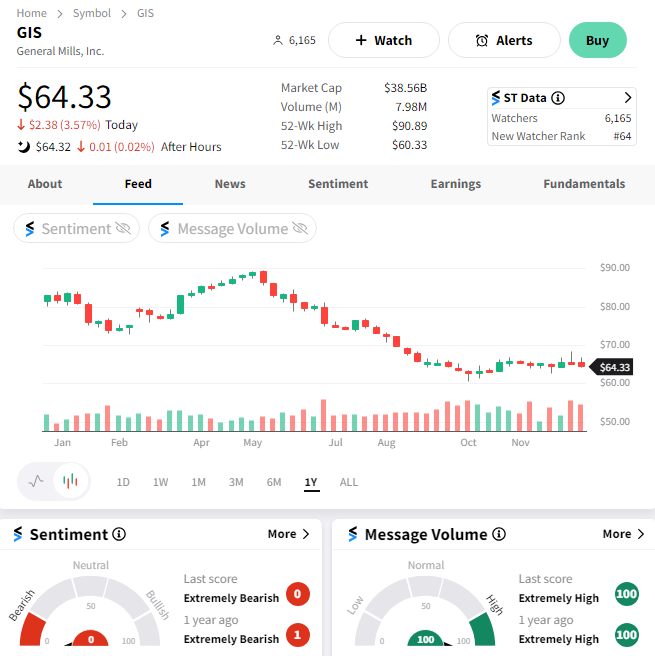

$GIS shares were down about 4% on the day, continuing its decline from all-time highs set in May. The Stocktwits community remains bearish as the stock sits at levels first seen in 2016. 🐻