Airline stocks are trying to pull themselves out of a hole after the last few weeks of Boeing plane issues. Luckily for United Airlines stock, its earnings helped boost shares after hours. 👍

First, the airline said that the FAA’s grounding of the Boeing 737 Max 9 earlier this month will likely remain in effect through January 26th. As a result, it expects a quarterly loss of 35 to 85 cents per share due to the grounding. Although the focus has been on Alaska Airlines, where the door issue occurred, United has more of the aircraft in its fleet than any other carrier, at 79. 🛬

As for the fourth quarter, adjusted earnings per share of $2.00 topped expectations of $1.70. Revenues of $13.63 billion also narrowly beat estimates of $13.54 billion.

Executives cited that travel demand remained strong late last year and through the first few weeks of 2024. As a result, the company expects full-year 2024 adjusted earnings of $9 to $11 per share, matching analyst expectations. The company’s premium cabin revenues rose 16% YoY, while basic economy jumped 20% YoY. 🔺

Some analysts say this is a clear sign the airline’s more aggressive focus on transatlantic travel and higher-end seating and amenities has been paying off. International travel demand will remain a tailwind for the company as domestic flight routes become more crowded and further weigh on ticket prices. 🌍

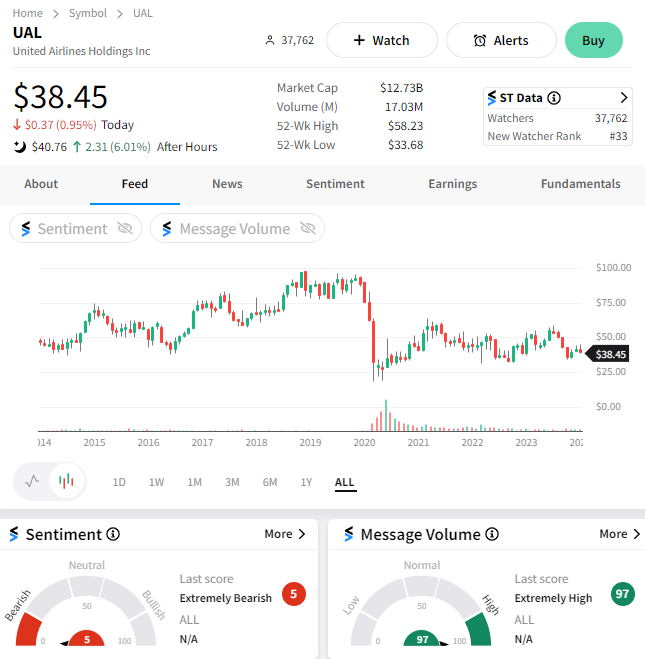

Despite forecasting a wider-than-expected loss for the current quarter, $UAL investors appear to be buying the recent dip and sending shares up 6% after hours. Despite the price action, the Stocktwits community continues to heavily debate the airline’s future, with sentiment readings currently in “extremely bearish” territory. 🐻